Have We Finally Tamed the Beast of Inflation?

Finally, some good news Tuesday on the inflation front that investors may be able to rely upon.

May’s Consumer Price Index increased by 0.1% on a monthly basis and 4% over the last year, the lowest annual rate since March 2021. Core CPI (excluding food and energy) rose 0.4% monthly and 5.3% annually. As an aside, we find this core measure somewhat perplexing as an indicator of price stability since it excludes the items that are the biggest percentage of the average consumer’s budget after housing. (Source: Bureau of Labor Statistics)

Back in August 2022 (Is the Market Crying Wolf on Long-Term Inflation?), we argued that inflation might follow a similar post-COVID pattern as many other market variables.

Despite attempts to compare the experience to previous economic and market periods, mostly confounding supposed logic at every turn, a familiar pattern unfolds. First, there’s a run-up based on real and perceived trends. Next, things stabilize for a period at higher levels. Finally, a massive pullback occurs when it’s obvious the circumstances causing higher expectations are fading… Maybe there is something similar happening with inflation.

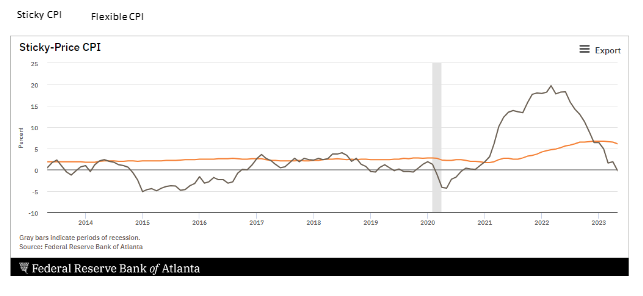

Since our August blog, we have seen disinflation take hold after a period of price stability. However, as evidenced by the chart below, not all components of CPI are created equal. While Flexible CPI (faster to change components) has rolled over dramatically, essentially in line with the supposition above, Sticky CPI (slower to change components) has only recently started to roll over and decline.

We may have found a culprit – “greedy” companies that have continued to raise prices and test their pricing power even as input costs have moderated. A recent article in the NY Times (Companies Push Prices Higher, Protecting Profits but Adding to Inflation) suggests that investors are now more focused on volume gains over gross revenue as an indicator of secular growth as pricing power wanes.

Welcome to the party.

In December 2022, we pointed out that companies were using higher input costs as de facto air cover to increase prices. (Is inflation no longer the Bogeyman?) We wrote:

Over the last six months, companies have scrambled to raise prices justified by supply chain issues and input and wage pressures. But they did not stop when they reached equilibrium – often pushing prices higher and enhancing margins because they could. As supply chain issues have eased and input prices have declined, have companies lowered their prices? Not yet. But as volumes wane, they may be faced with lowering them very quickly, accelerating the decline in inflation.

After a cumulative 5% increase, for the first time in 15 months, the Fed did not raise the Fed funds rate, opting instead for a hawkish pause, or a “skip”. Instead, they let a new “dot plot” and a hawkish presser by the Fed Chair do the heavy lifting. Although not official, this simple form of data visualization suggested two more 25 bp rate hikes before year-end and no rate cuts, meaningfully different than market expectations. According to Bloomberg, Fed watchers remain skeptical of the Fed’s resolve with only a slight increase in the probability of a July rate hike (now 62%) and a peak rate of 5.3%, not the 5.5% indicated in their dot plot. And they are still holding out for rate cuts beginning in December, although with less confidence.

Despite all the good inflation news, employment remains stubbornly strong, and that matters to the Fed. Again, back in December 2022, we wrote:

In Powell’s question and answer session, he indicated that the Fed is partly shifting its focus to employment as a proxy for success in bringing inflation to heal. In other words, only higher unemployment rates will quell wage inflation, the most impactful and stubborn component of inflation…. Powell seems intent on breaking their collective will and forcing them back into the labor market, thereby subduing overall wage inflation with a greater labor supply.

How does the Fed now reconcile higher employment and inflation? Eventually, we think by revisiting the assumptions that link employment, wage increases and higher consumer prices.

A recent (6/12/23) article from Bloomberg (Fed Backs Away From Wages Focus, Bolstering Case for Rate Pause) suggests that there is growing consensus inside the Fed and among economists that the previously assumed direct link between wages and prices may be more complex than once assumed.

It is much better to have a data dependent Fed – not everything needs to be telegraphed in detail to “not spook” investors. We are big kids; we can handle some uncertainty.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.