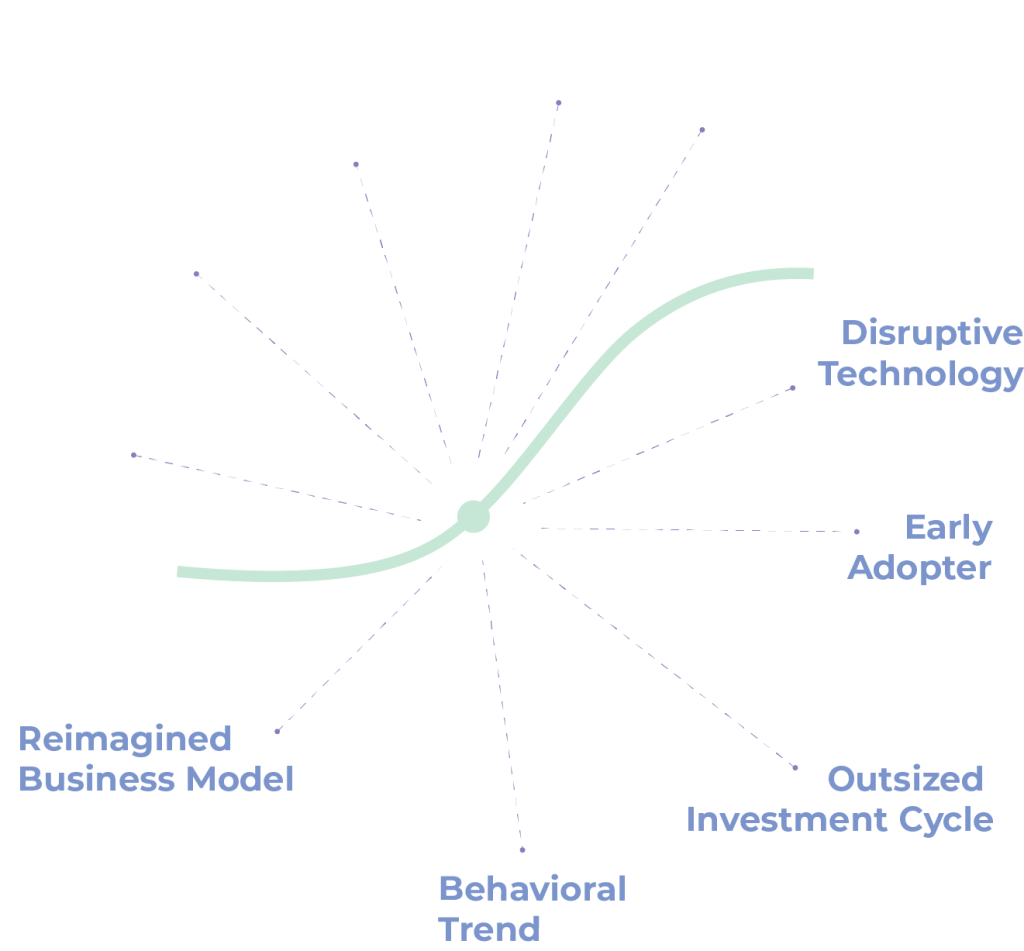

Investing at the

Edge of Inflection

Let our original research guide you to the inflection point of accelerating growth and beyond

inflection points are key events that significantly change the trajectory of a company, industry, sector, economy, or geopolitical situation. Our research seeks to validate key turning points that lead to meaningful change we can capitalize on as they unfold.

EV, Gig-economy, etc. Easy to see and imagine huge opportunities (TAM). Harder to succeed. Lots of execution risk. Lots of investment risk.

Let someone else innovate. Follow fast. Applying proven strategies to meet an obvious need. Execution is straightforward if you follow the template.

How significant must the opportunity be for management to sacrifice near-term results for future revenue and earnings acceleration? Courage, brilliance, or desperation?

Opportunities hiding in plain sight. Peter Lynch’s idea of investing in what you are experiencing in day-to-day life.

Recurring service over product sale. Initially applied to software, now applies to everything from gaming to fashion. Jettisoning ancillary businesses, doubling down on best opportunities.

Transformation that permanently disrupts underlying dynamics of industry or asset class from bottom-up. Initially, not well understood or accepted. Early recognition of impacts spells opportunity.

Wholesale re-rating of valuation metrics for an entire sector based on changing market dynamics, perceptions of future growth, or economic importance. Value trap or buying opportunity?

Modifications in behaviors and preferences can take years, but eventually wash over the global business community like a tsunami. Fail to adapt at your own peril. Early “winners” may fade over time.

Circumstances and fluctuating priorities create meaningful modifications to rules and regulatory oversight. As rules of the game shift, will incumbents adapt, grow stronger, or be left behind?

Seemingly from nowhere, forces collude to disrupt the commonly held precepts of how an industry functions, catching industry pioneers and crucial players offsides. Who will step into the breach?

At every stage of a company's evolution

Seed Stage

Growth Stage

Pre IPO

Small Cap

Mid Cap

Large Cap

Here’s our top five holdings within the four major categories across the different strategies we manage and advise.

PUBLIC EQUITIES

- Ready Capital Corp

- New Lake Capital Partners

- Owl Rock Capital Corp

- Pioneer Natural Resources

- United Health Group Inc

ALTERNATIVE CREDIT

- Canyon CLO Fund II

- Canyon CLO Fund III

- Ovation Alternative Income Fund, LP

- Arboretum Core Asset Fund, LP

PRIVATE REITS

- Clarion Lion Industrial Trust

- Treehouse REIT, Inc

- Preservation, REIT, Inc

- Aventine Property Group, Inc

- Healthcare Trust, Inc

STARTUPS/DIRECT EQUITY

- GoSite

- AlwaysAi

- Clear Street

- Iridia

- EatJust

The top five holdings above are listed by assets invested as of 05/31/2022

GET YOUR GROWTH GOGGLES ON!

It’s Hard to See Growth Opportunities as They Unfold–No Matter How Near or Far.

Rooting them out before followers can fully appreciate and capitalize on them is essential to investment success. It requires relentless focus on the factors that presage a change in business direction or momentum. It’s kinda like if you had powerful pair of growth goggles that let you see opportunities as they unfold.