What is Inflection and is Mexico Experiencing One?

Our CIO, Mark Scalzo, recently participated in a fire-side chat along with Rafael Fernandez de Castro, Ph.D., and others at the Longley Capital Summit hosted by University California San Diego (UCSD). The subject was inflection—specifically, as it relates to the recent surge in companies moving their offshore resources closer to home. Here’s a blog our CEO wrote about nearshoring back in November.

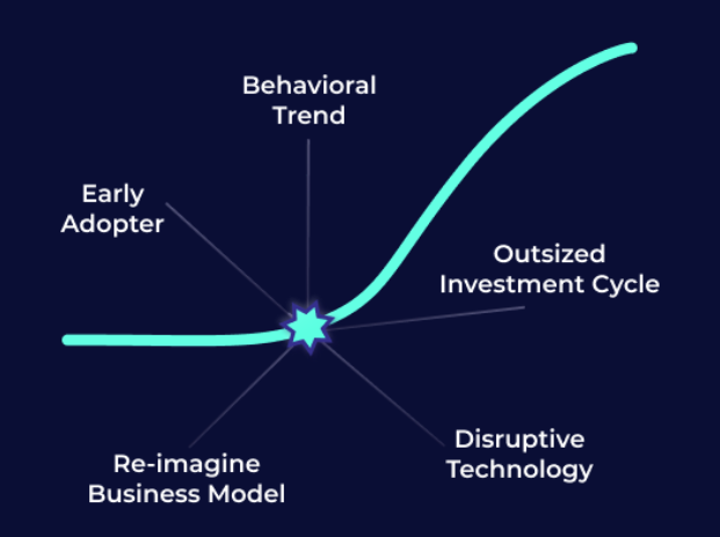

In calculus, inflection is the point where a curve changes from concave to convex. In the business world, it has come to mean a turning point indicating a dramatic change.

In search of investment opportunities, the first step in our research process organizes inflection by company and the market. From a company perspective here are the five inflection points we look for:

- Behavioral Trends – Opportunities hiding in plain sight. Peter Lynch’s idea of investing in what you know and experience in day-to-day life.

- Disruptive Technologies – Cutting edge of technological innovation (EV, Gig-economy, etc.). Easy to see and imagine huge opportunities – total addressable market (TAM). Harder to succeed. Lots of execution risk. Lots of investment risk.

- Early Adopters – Let others innovate and follow once demand is confirmed and product / service / feature is perfected. Apple is a great example. Applying proven strategies to meet an obvious need. Execution should be straightforward if you decode the template and follow the steps.

- Reimagined Business Models – Finding alternative ways to capitalize on changing consumer demands. Best example is “…-as-a-service” transformation. Initially applied to software, now applies to everything from gaming to fashion. Demonstrating courage to jettison the distractions and double down on best opportunities.

- Outsized Investment Cycles – How significant must the opportunity be for management to sacrifice near-term results for future revenue and earnings acceleration? Courage, brilliance, or desperation – how can you tell the difference?

And here are the market inflections that further inform our initial investment process:

- Secular Leaps – Transformative change that permanently disrupts the underlying dynamics of an industry or asset class from the bottom-up. Initially, not well understood or accepted by investors. Early recognition of primary and secondary impacts provides opportunity. Example: Introduction of the smartphone.

- Global Re-Pricings – From time to time, investors en masse will re-rate the multiples on an entire sector based on changing market dynamics, perceptions of future growth, or economic importance. Value trap or buying opportunity? Example: Rising rates impact on TECH in 2022.

- Societal Shifts – Typically, modifications in behaviors and preferences take years to build, but eventually wash over the global business community like a tsunami. Fail to adapt at your own peril. Early “winners” may fade over time. Example: ESG Investing.

- Regulatory Regime Changes – Circumstances and fluctuating priorities can give rise to meaningful modifications of rules and regulatory oversight. As the rules of the game shift, will incumbents adapt, grow stronger, or be left behind? Example: Recent changes to EU privacy standards.

- Extinction Level Events – Seemingly, out of nowhere, forces collude to disrupt the commonly held precepts of how an industry functions, catching some industry pioneers and crucial players offsides. Who will step into the breach? Example: Current Crypto and Banking crises.

As for Mexico, there are several factors indicating the potential of a meaningful inflection for the purpose of investing:

- Regulatory Regime Changes — Trade tensions with China pushed companies to diversify supply chains

- Extinction Level Event — The pandemic accelerated the need for diversified supply chains after companies couldn’t easily get inventory

- Societal Shift — US has a long-standing trade relationship with Mexico (think NAFTA/USMCA)

These three inflection factors have driven the ‘nearshoring’ of a wide array of goods and services, ranging from manufacturing to app development in Mexico. It is our view that the near-shoring theme has potential investment significance over the next 10 years, as US and global businesses look to optimize the geographic footprint in relation to their end customers.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.