Is inflation no longer the Bogeyman?

The Fed seems relentless and immovable – raising rates another 50 bps yesterday and 4.25% in cumulative raises for the year. A month or two ago this “deceleration” would have been welcome news as expectations were for another 75 bps increase.

Today, not so much.

Chairman Powell’s tough talk and hawkish stance now seems somewhat disconnected from reality and this has the market very concerned. Indeed, there is mounting evidence that inflation has rolled over – Tuesday’s CPI (Consumer Price Index) for November came in “cooler” than expected, up 0.1% vs. a 0.3% expectation. The current consensus view seems to be that inflation will come down much faster than most expected, even a few months back.

Interestingly, we came to this conclusion back in August in a blog post I wrote on the subject. We still believe that inflation will eventually settle at higher levels than we are used to in recent memory – perhaps around 3%. This may eventually prompt a change in the Fed’s target rate – something that Powell did not completely dismiss when specifically asked during the Fed’s presser yesterday.

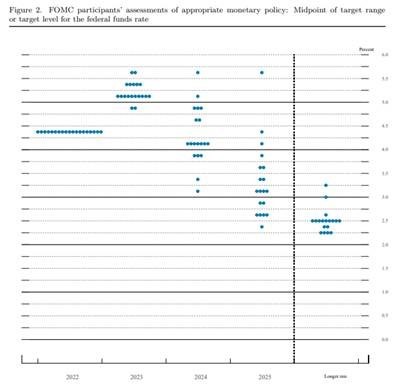

Perhaps more meaningfully then, the Fed published a new “dot plot” (see below) fed funds rate forecast which showed a consensus terminal rate of 5.1%, up 50 bps from the last dot plot in September.

Notably the distribution of these predictions looks skewed to even higher levels with 7 of the 19 committee members predicting a rate higher than 5.25%. While the Chairman was quick to caution that this chart did not equate to monetary policy, he then proceeded to call out these projections in making his case for the Fed’s current hawkish stance. This fits well within the new “higher for longer” narrative that many market bears tout for their dire outlook.

Finally, in Powell’s question and answer session, he indicated that the Fed is partly shifting its focus to employment as a proxy for success in bringing inflation to heal. In other words, only higher unemployment rates will quell wage inflation, the most impactful and stubborn component of inflation. However, Powell also admitted that there may be structural reasons why many are still choosing to sit on the sidelines. Bending over backward to remain apolitical, Powell mentioned everything – deaths from COVID, early retirement, etc. – except what in our mind is the largest contributor, the massive benefits heaped upon those “unwilling to work” over the last few years. Powell seems intent on breaking their collective will and forcing them back into the labor market, thereby subduing overall wage inflation with a greater labor supply.

This rapid shift in sentiment to fears of recession is propelled by the idea that the net effect of the Fed’s actions will be another policy mistake – this time over-tightening based upon lagging data into a rapidly slowing economy. While the Fed is suggesting a terminal rate of 5.1% at the end of 2023, yields at the longer end of the curve are coming down very quickly, which few have flagged. Since the end of October, the 10-Year yield is down 60 bps to 3.45%. Across the board the yield curve is inverted – for instance, the 2YR-10YR spread is currently 78 bps, up from 43 bps at the end of October – a well-documented harbinger of economic recessions. Are markets now suggesting/predicting a hard landing? Maybe a harder landing than markets thought a month ago.

And, at last, the data finally seems to be starting to confirm an economic slowing (at the very least). Today, for instance, we received some disturbing economic data. Retail sales fell 0.6% vs. a 0.3% expectation stoking concern that the consumer, who may be single-handedly keeping the recession at bay, is tapped out. Meanwhile, anticipated manufacturing activity suggested contraction – the Empire State Manufacturing Survey posted a reading of -11.2 vs. a -0.5 estimate and the Philadelphia Fed Survey posted a -13.8 vs. a -12.0 estimate (both representing the percentage differences of companies reporting expansion against contraction). Even the Fed brought down its expectations for 2023 GDP growth yesterday to 0.5% from 1.2% in September.

Indeed, according to Bloomberg’s World Interest Rate Probability model, bond market participants believes that rates will peak at 4.88% in 2023 and finish the year at 4.40%.

How do we reconcile that view with the fervent denial by Powell of a possible rate cut in 2023 and the Fed’s prediction of 5.10% at year-end? We think the market wins, the Fed blinks and the fed funds rate ends up lower at the 2023 year end. Why? Generally, the bond market has been a much better predictor of economic conditions than economists, academics, and the Fed.

For its part, the Fed will continue to “talk tough” to keep longer term inflation expectations in check and to give itself as much monetary breathing room as possible right up until the moment that it capitulates, takes its foot off the brake, and is forced to provide fuel (easier monetary policy) to a struggling economy.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.