Mark’s Musings: Are Zombie Companies Eating your Market Share?

Zombies are a problem, just not in the way you thought.

In a report from the International Monetary Fund, the authors discuss the rise in zombie companies around the globe post-COVID — companies characterized by long-term unprofitability, high relative leverage ratios, and negative sales growth.

While it’s not surprising that pumping massive amounts of “emergency” liquidity (over multiple years) into the global economy would extend the runaways of companies that otherwise should not exist, zombies as a % of the total have been steadily increasing over the last 20 years (from 6% in 2000 to 10% in 2021) and have been surviving for longer periods — an average of 4 years after becoming a “zombie.”

More importantly, the report attempts to quantify the impact on economic activity overall – essentially arguing that it negatively impacts the performance of its non-zombie peers, “dampen[ing] investment, productivity and employment” while crowding out better companies from an increasingly limited credit supply. This slows growth overall. Interestingly, this problem seems to be less prevalent with private firms and less prevalent in economies with strong banking systems and robust bankruptcy laws. Why? Apparently, due to a better ability and need to sort the quick from the dead.

Most interesting to us, it may be possible to identify potential zombies prior to actual zombification. Deterioration starts to occur several months prior to becoming an official zombie. To us, this is further confirmation that paying attention to things like changes in default probabilities, a meaningful part of one of our validation pillars, can help to lower risk when considering public companies. Sometimes, companies are cheap for a reason.

The Rise of the Walking Dead: Zombie Firms Around the World (imf.org)

Is California an early indicator of a broader US recession?

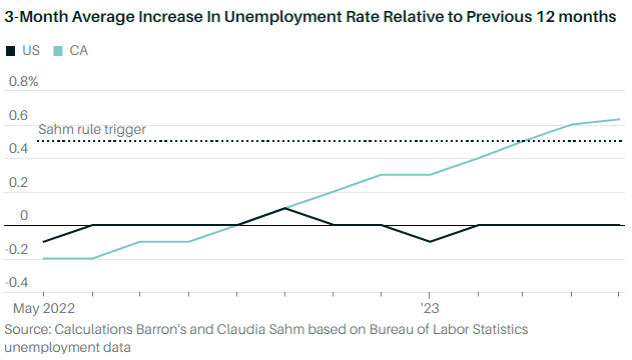

Even as the national unemployment rate remains historically low, cracks are beginning to appear in the employment picture. California, the 8th largest economy in the world by GDP, has seen a steadily increasing unemployment rate – from 3.83% in August 2022 to 4.50% in May 2023. According to the Sahm Rule, when the 3-month moving average of the national unemployment rate rises 0.5% or more relative to its 12-month low, it signals a recession. According to some, this concept can also be applied to state economies. Further, once the rise in the unemployment rate exceeds this threshold, it tends to climb from there – by another 1.5-2.0% over the next few months. This is because a negative cycle tends to reinforce itself as the unemployed spend less.

Perhaps California is an outlier (certainly our East Coast friends would agree!) – after all, many layoffs/ job losses have been concentrated in the tech sector in general and Silicon Valley in particular. However, some of California’s issues are due to changes in behavior – the article below points out that California has the highest concentration of remote workers of any state, hurting ancillary businesses. Beyond that, California has long been seen as unfriendly, even hostile to business with a “take it or leave” attitude in some of its interactions. Just ask Elon Musk. Only time will tell if this is a precursor to a larger US problem, or just part of the cost of living in La La land.

Is the Economy Headed for Recession? California Triggered an Indicator. | Barron’s (barrons.com) [Paywall]

Rents about to inflect?

A key component of “Sticky CPI” may be about to roll over. In the latest CPI report in May, gains in the cost of shelter were the biggest contributor to the monthly increase. We have long been skeptical of some aspects of the shelter component as representative of the true cost of housing, specifically, the owners’ equivalent rent (OER) based upon the “implied rent” that owners indirectly pay to live in their homes. Over the last few years, OER has represented roughly 25% of CPI. How do they determine implied rent? By asking consumers who own a primary residence how much they would pay to rent their own home. Really? But it seems that rents are now decelerating, due in part to new supply in the multi-family (apartment) space as the pace of construction remains healthy. A measure from Redfin suggests that “asking rents”, a slightly forward-looking indicator, actually declined by 1% from the year prior in May. And maybe that will start to change the perspective of those surveyed each month.

Rents Keep Rising but That’s About to Change | Barron’s (barrons.com) [Paywall]

Can the lessons of COVID drug development motivate further positive change in the pharma industry?

Lessons learned from the swift rollout of COVID vaccines demonstrate what’s possible given the right motivation, circumstances, and partnerships – a 15-year development timetable was shortened to 8 months. Obviously, this was a rare alignment of public and private interests that may never recur (let’s hope). But this experience has led biotech and pharma companies to reevaluate age-old, mostly manual processes that drive successful early-stage drug formulations to commercialization (described as “technology transfer”). “Digitizing the treatment recipe from drug discovery and development all the way across the pipeline until it is manufactured at scale” is the area of greatest focus. The key seems to be creating a standardized platform that can translate and homogenize data across disparate platforms. If embraced by industry, the impact could be dramatic for biotech and pharma companies. Remember, for these companies the clock is always ticking — the faster-to-market, the more benefit from an expiring patent.

Swift Technology Transfer Could Cut Years off Drug Development Timelines | IndustryWeek

The end of plentiful, inexpensive water?

The explosive growth of Phoenix’s suburbs has relied on the assumption that the vast aquifer system in Arizona held enough groundwater for 100 years. Unfortunately, and somewhat surprisingly, Arizona just announced that there’s not enough groundwater to meet projected demand, and new housing construction in the region will be restricted going forward. This coincides with restrictions being enforced on a federal or a multi-state level, beginning last year when the federal government cut Arizona’s draw from the Colorado River by 21%. Under more federal pressure, three states (Arizona, California, and Nevada) agreed to a further 13% cut in May. Enterprising city officials, perhaps recognizing this potential as a risk, had already secured additional water sources 200 miles upriver from large institutional investors who have aggressively amassed large farmland positions, in part for the water rights, over the last 10-15 years. But this is likely the equivalent of “robbing Peter to pay Paul.” The conclusion – get ready to pay more for water and more for new construction in Arizona.

Arizona Suburbs Tap Private Water Market to Build More Homes (bloomberg.com) [Paywall]

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.