When Passive Investing is Active

When one invests in an index, it is often assumed to be a passive strategy. Well diversified means to gain broad exposure to the market. But too often, people make investments they do not understand, or would ever even want—if they knew what they were investing in. Earlier this quarter, in an article titled Top Heavy Performance, we pointed out the performance of the S&P 500 Index that was being driven by a small group of mega-cap stocks.

Sure, experiencing an upturn is always great while it lasts. But what happens when these stocks go through a period of underperformance, or reversion to the mean, which often occurs?

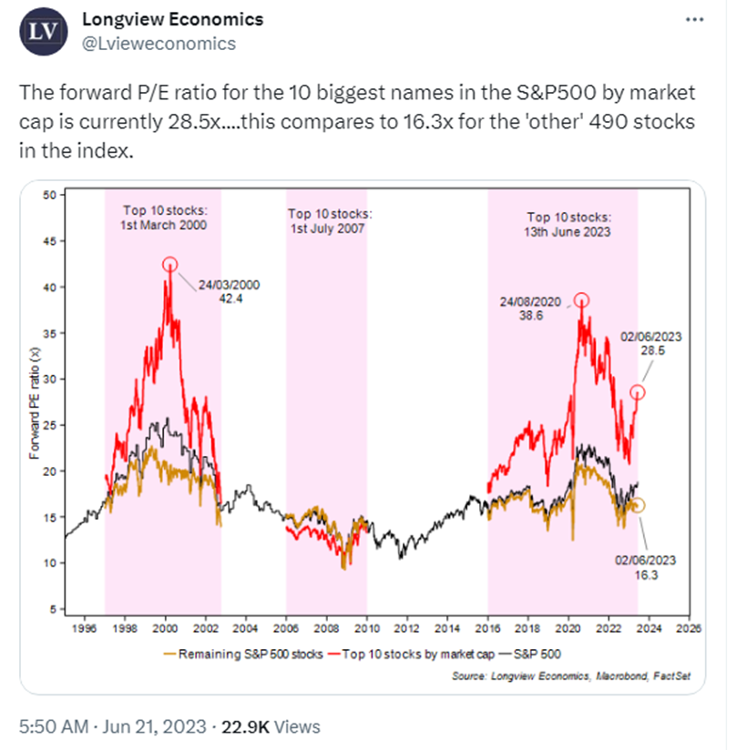

Recently, we came across this chart from Longview Economics that shows the valuation disparity of those same top 10 mega-cap stocks we talked about in our May 10th post.

The Longview team challenges the narrative that equity markets are broadly overvalued and trades at a premium to historical norms. This is true for only the largest stocks in the index, which according to Longview trade at a 28.6x Forward P/E Ratio vs. 8.6 turns over the S&P 500 Index overall at 20.0x and 12.3 turns over the remaining 490 stocks in the index at 16.3x. More importantly, while these conditions can persist for some time, eventually that valuation gap is revolved negatively, if prior history is any guide.

This over-concentration of mega-cap stocks is one reason we like individual securities. It allows us to make specific investments in fundamental inflection stories we can understand while identifying specific risks and structuring the investment accordingly.

So, if you are a “passive” index investor, you might consider thinking actively to better address your exposure to risk.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.