The Forever CEO – a Good Thing?

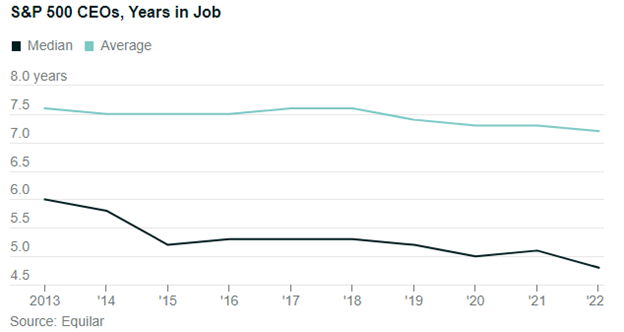

According to a recent Barron’s article that cites an about-to-be-released study by Equilar, the average tenure for S&P 500 CEOs between 2013 and 2022 was down only slightly from 7.6 years to 7.2 years. That small change glosses over the real story – the impact of the long-term CEO which skews the averages higher. Looking at the median instead, identifies a more dramatic shift — during the same period, the median CEO tenure dropped by 20%, from 6.0 years to 4.8 years.

Is it harder to be a CEO today?

We would argue that it is. While there has long been a short-term imperative to deliver quarterly, estimate-beating results, new variables are constantly being added to the equation. The speed of information flow from traditional sources has accelerated and the rise of non-traditional sources has added further complexity, forcing much smaller reaction times which may not provide enough space for well-thought-out longer-term decisions. In this regard, the article points to “radical transparency on social media, including employee opinion-driven sites such as Blind, critiquing every move….” and the “maw of environmental, social, and governance factors and hot-button cultural issues.” But a lot of things are harder than they used to be — should that provide a blanket excuse? We don’t think so and it appears corporate boards don’t either.

The best CEOs walk a fine line.

They can realistically address current concerns and challenges while keeping all stakeholders focused on bigger-picture, longer-term objectives. Perhaps even making better “seat of the pants” decisions based upon a greater depth, context, and experience — akin to the 10,000-Hour Rule popularized by Malcolm Gladwell in Outliers.

What does it mean for stock price performance?

That said, the link to the stock price performance of companies with longer-tenured CEOs seems weak at best. According to Spencer Stuart, over the last 20 years, 25% of companies with CEO survivors (those holding the CEO job for 10 years or more) generated just 1% higher annual total returns. However, the article points out that a lack of clarity and stability in the CEO position can be a big detractor to shareholder value.

The conclusion — a steady hand does not always pay off, but a revolving door C-suite can be significantly detrimental to performance.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.