Top Heavy Performance

It’s fair to say that markets have behaved unusually since the start of 2023, in the face of:

- Mounting irrefutable data that an economic slowdown, or maybe even a full-blown recession, is taking hold;

- Increasing signs that consumers are pulling back and having to make difficult choices, at best, or completely tapped out, at worst;

- a meaningful banking crisis brought on by a dramatic loss in confidence in the banking system;

- and the Fed’s seeming obliviousness to all of this as it forges ahead with its rate hikes, convinced that any sign of weakness would be catastrophic to its objectives.

With all that, the equity markets, as represented by the major indexes, are having a great year with the S&P 500 Index up 8.3% and the Nasdaq Composite Index up 17.2% as of Friday May 5th.

But this isn’t all that it seems…

A broader measure of the market’s performance breadth, the S&P 500 Equal Weighted Index, is up only 1.8%.

And it gets more interesting from there…

According to Bloomberg, the top six stocks in the SPDR S&P 500 ETF Trust (SPY)–which make up 24% by weight–were responsible for roughly 81% of the ETF’s return and fewer than one-third of the components outperformed overall.

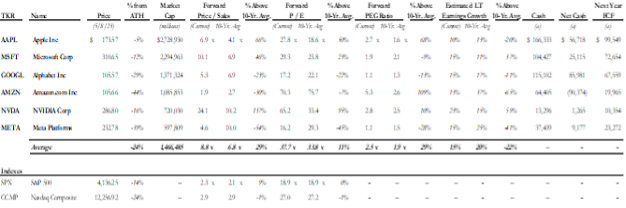

For 2023 through 5/5/23:

- Apple ($2.7 trillion market cap) was up 33.8%;

- Microsoft ($2.3 trillion market cap) was up 29.9%; *

- Alphabet ($1.4 trillion market cap) was up 19.7%;

- Amazon ($1.1 trillion market cap) was up 25.8%;

- Nvidia ($0.8 trillion market cap) was up 96.3%; and

- Meta ($0.6 trillion market cap) was up 93.4%.

*See disclosures

Wow!

The largest companies in the market continue to levitate, even though in some cases fundamental results are not keeping pace. Take the bellwether of the bunch – Apple. In the latest quarter, revenue growth year over year was -2.5% and sequential growth was -19.1%, respectively. Hardly the stuff of legend. According to the analysts, Apple has an expected long-term EPS growth rate of 10%, down 20% from its 10-year average. As of 5/5/23, Apple trades 66%, 49% and 68% above its 10-year average Forward P/S, Forward P/E and Forward PEG ratios, respectively.

We don’t mean to pick on Apple – great business, great ecosystem, great moat. Just listen to Warren Buffet who sang its praises over the weekend! Certainly, these companies have tons of cash, massive ongoing cash flows and are buying back stock aggressively. In fact, this group represents about $500 billion in cash. This is probably a better credit risk than the US government these days! But great stock from here?

Some of this is likely reversion to the mean – Meta, Nvidia, Amazon and Google were down 64%, 50%, 50% and 39%, respectively in 2022. But that could be said for most stocks after 2022. Some of this is probably the market’s muscle memory – “dancing with the date that brought them” over the last ten years. Possibly, it’s just good-old-fashioned marketing.

These companies are certainly adept at surfing the wave of soundbites that the market is longing to hear in an uncertain environment – artificial intelligence, cost savings, etc. Meta went from loudly beating the drums for the metaverse in 2022 (even changing its name!) to touting 2023 as the “year of efficiency.” Exactly what investors in 2023 wanted to hear – well done!

According to Bloomberg, the word “AI” was uttered more than 200 times on earnings calls by Meta, Alphabet and Microsoft.* Conveniently, AI is the one area of capital spend that the market is happy to endorse in profligate quantities. But, most likely, it’s a flight to safety.

At a time of unusual uncertainty, investors scramble to these mega cap companies because their strong competitive “moats” and massive scale are unassailable and therefore more recession proof. Well-reasoned for sure.

But how secure is Google feeling these days with its invincible market position in the face of generative AI competition from OpenAI and others? Meta continues to be challenged by Tik Tok and has pinned its competitive hopes on regulators taking action to curtail Tik Tok’s business in the US on national security grounds, in a way that deflects attention away from social media’s negative impacts in general. Don’t get us wrong, we are no big fans of ByteDance and its Chinese connections — they are a convenient villain.

Before you start pinging us, these are certainly great companies and we do not fault anyone for owning them–certainly, the right call so far! It just seems to us that they have “punched above their weight” when comparing stock price performance to underlying fundamental performance which is likely to lead to some disappointment in the coming months.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

*The Rising Dividend strategy and the Destra Multi-Alternative Fund that is sub-advised by Validus have an allocation to Microsoft. Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed and securities discussed in this blog may or may not be held in such strategy or portfolios at any given time. These individual securities do not represent all of the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.