No Turning Back – Nearshoring is Here to Stay

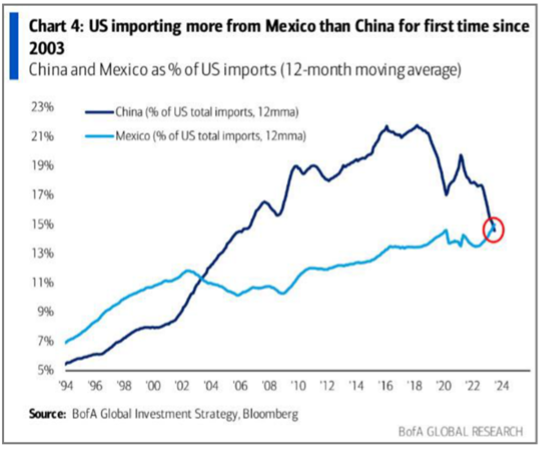

For the first time since 2003 the US is importing more from Mexico than China based upon a 12-month moving average, according to B of A Global Research.

Nearshoring is the most obvious example of the unwinding of globalization due to a number of factors including:

- Rising internal and external political uncertainty

- Higher transportation and logistics costs

- Country-specific strategic considerations

Here’s a couple other blogs we’ve posted on the topic over the past year: What is Inflection and is Mexico Experiencing One?, Is Mexico the Next China and is this the Right Time to Invest?.

The COVID experience taught everyone that the longer and more complicated the supply chain, the more likely the opportunity for disruption. The solution — make things closer to the ultimate source of demand.

Workers educated and trained in Mexico are at least equivalent to peers in far-flung places like India and the Far East in terms of their talents and capabilities. Increasingly, these human resources can be accessed at costs that, in some cases, are actually lower than overseas alternatives. Not to mention the much closer connection both geographically and culturally. Workers who are competent, closer, cheaper, and more like us – what’s not to like? US manufacturers have known this for years, but now it is manifesting in areas like software development, financial services and other technology-adjacent industries.

Perhaps most importantly is a loss in confidence in China as the global producer, due to draconian and unpredictable social and economic policies (i.e. unending COVID lock-downs) and the narrowing of the gap with other alternatives in terms of its economic advantage (i.e. Vietnam, Indonesia, Mexico).

US companies have always known that access to Chinese markets come with a cost – less intellectual property protection and idiosyncratic rule of law, for instance — but today many are re-evaluating that cost/benefit equation. And the decision is a lot less clear than it used to be. Throw in potential conflict in Taiwan and the South China Sea and most companies have no choice but to diversify their risk and move more meaningful portions of their production and supply chains to other jurisdictions.

The nearshoring trend is also being turbocharged by the revised NAFTA agreement that no one speaks about – largely, we assume because it indirectly gives credit to the previous US administration. Not that we agree with the tactics or the bullying, but let’s at least acknowledge that the USMCA cleared the deck of previous disputes and set the stage for the nearshoring wave. This can be seen in the relative performance of the Mexican and Chinese markets since the USMCA went into place. Since the end of 2020, the Mexican stock market, as represented by iShares MSCI Mexico ETF (EWW), is up +49.6% while the Chinese stock market, as represented by iShares China Large-Cap ETF (FXI), is down -38.5%.

It is clear Mexico, Canada and the US are leading a global wave to regionally focus resources and logistics. And we are especially excited about the continued growth of our Mexico brethren. The sky is the limit.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.