International Shark Attacks Domestic Portfolio

Last week our CIO, Mark Scalzo, answered the question, Why Global?? In his post, he pointed out five compelling reasons this might be a good time to think about your asset allocation to non-US stocks. They include:

- De-Globalization

- Cost of Capital

- Relative Value

- Reversion to the Mean

- USD Under Attack

Since we heard what Mark thinks, I thought it would be useful to see what other experts are saying about global investing.

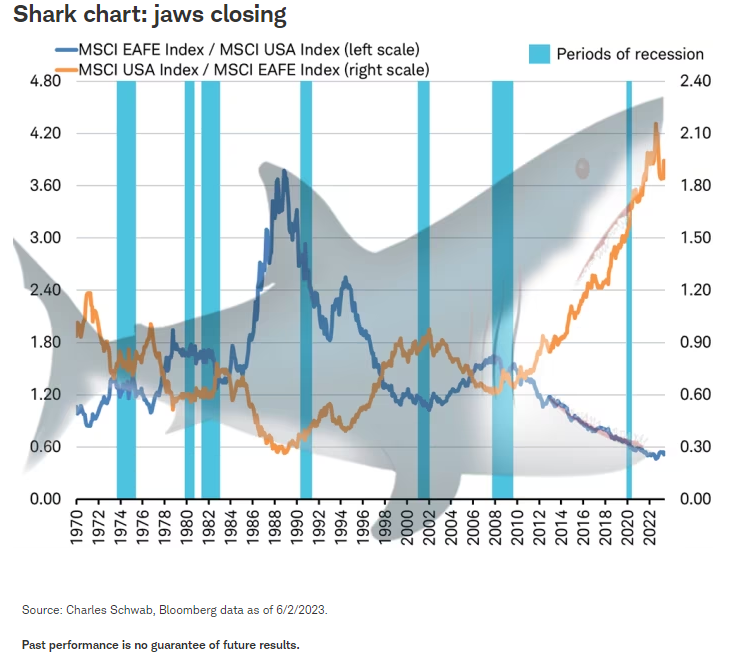

On June 5, 2023, in his mid-year outlook, Jeffrey Kleintop at Schwab shows what stock market shark attacks look like using the relative performance of U.S. and international stock indexes in the chart below. “The lines are just the ratio of one index divided by the other. When the blue line is rising, international stocks are outperforming U.S. stocks. When the orange line is rising, U.S. stocks are outperforming international stocks. They are mirror images of each other.”

What we are seeing now hasn’t happened since the 80’s. There were baby shark attacks around recessions in the 1970s and 2000s. The question is, will the shark’s jaws continue to open or will they bite down, with international stocks outperforming the US for the next decade?

In his article titled, Why You Shouldn’t Bail Out on International Stocks, Dr. James M. Dahle points out, “There are 195 countries in the world today. However, when it comes to publicly traded stocks, 60% of the market capitalization is in the United States, as of late 2022.” He adds, “It hasn’t always been that way. In fact, Japan in 1989 had a higher market capitalization than the US did. It has been highly variable over the last century plus.” It’s important to remember that approximately 8,000 of the 12,000 publicly traded companies in the world are not in the United States.

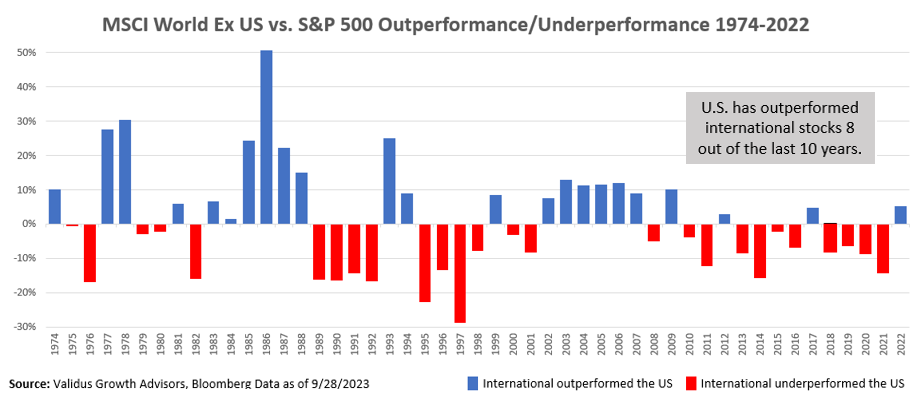

If you go all the way back to 1973 (when the best data first started), you can see sometimes US stocks outperform and sometimes International ones do.

Dr. Dahle points out that, since 1975, the outperformance cycle for US vs. International stocks has lasted an average of eight years. As of the end of 2022 the US has outperformed 8 out of the last 10 years and we are 12.3 years into the current cycle of US outperformance based on 5-year monthly rolling returns.

But maybe you’re more like Vanguard founder Jack Bogle who believes that non-US stocks don’t merit inclusion in investors’ portfolios because “US companies, especially U.S. large caps, get plenty of their revenue from selling goods and services overseas.”

Everyone knows the U.S. market has grown increasingly top-heavy with large technology stocks. Global portfolios provide a diversification benefit over domestic to such a degree that expansion beyond domestic borders has become increasingly necessary going forward.

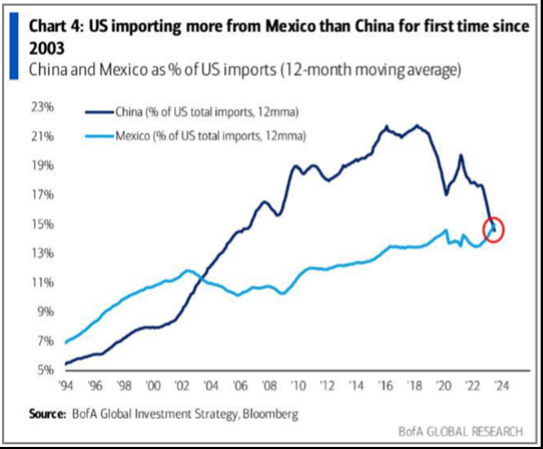

Sure, recent history makes a strong argument for an over-concentration to the US. But isn’t that how it always goes? Extrinsic market dynamics shift and the next thing you know the opposite is true. For example, Validus Growth’s CIO, Mark Scalzo, points out in his recent post how, “for the first time since 2003 the US is importing more from Mexico than China based upon a 12-month moving average, according to B of A Global Research.”

The result is, since the end of 2020, the Mexican stock market, as represented by iShares MSCI Mexico ETF (EWW), is up +49.6% while the Chinese stock market, as represented by iShares China Large-Cap ETF (FXI), is down -38.5%.

So will the jaws of the international market clamp down and take a bite out of your US allocation, or will US stocks continue to dominate?

This might be a good time to remember that, at the end of a cycle, the laggers tend to become the leaders. And most of all, never forget Investment management is simple, but it isn’t easy. Those who forget this are bound to miss out when markets shift.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

Validus Growth Investors, LLC seeks to invest in global companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

IMPORTANT DISCLOSURE:

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.