Why Global?

Why is global equity exposure important? Here’s why…

• De-Globalization. Globalization homogenized returns – for countries, for companies. De-globalization means the “country risk” becomes very important. As we all know, there are big differences in political and legal systems, economic and monetary philosophy, demographics, and cultural norms across the globe (to name a few). As costs rise, most countries are increasingly turning inward wherever they can, focusing on sourcing inputs and selling goods in closer geographies. Increasingly, prospects for individual countries will differ, providing opportunity for those paying attention.

• Cost of Capital. An artificially low cost of capital around the globe has had the same impact – a rising tide lifting all boats, more or less in sync. No more. Capital with a real cost means (1) not every idea gets funded, (2) not every stock goes higher and (3) not every country benefits / suffers in the same way.

Both will require differentiation, distinction, and specificity. As such, investing abroad will return to being a risk diversifier. This is contrary to our recent experience and therefore, to what most people have been taught – that investing outside the US is inherently more aggressive, and therefore should only be reserved for the most sophisticated investors, like hedge funds.

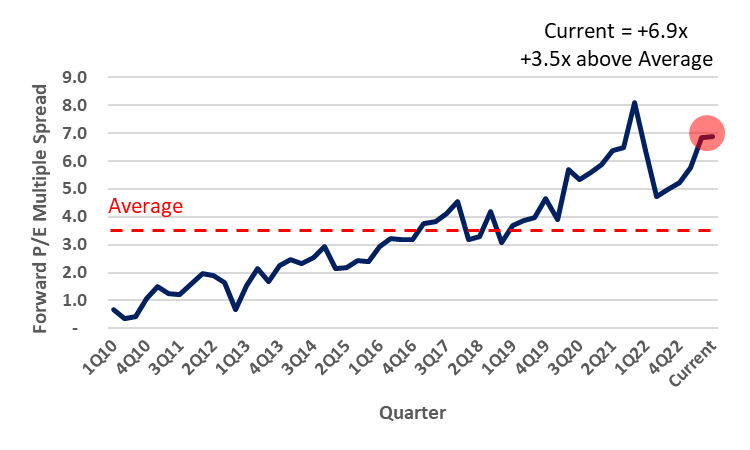

Relative Value. With rising interest rates now impacting the longer end of the curve, discount rates for future cash flows are moving higher. In principle, on a relative basis, higher multiple markets should prove less attractive. Currently, the US market, as represented by the S&P 500 Index, trades at an average of +6.9 multiple points higher than International markets, as represented by the MSCI ACWI ex-US Index.

While there are some legitimate reasons for the US to trade at a premium over time, the current relative value “bump” for US markets is 3.5 multiple points higher than the average since 2010. In a world in which capital has a real cost, relative value will matter again.

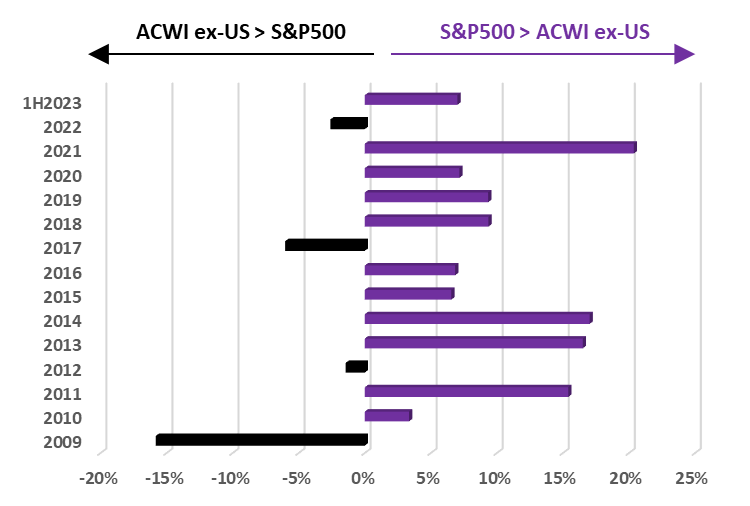

Reversion to the Mean. While we would agree that counting on this mathematical principle is not a strategy, it has to be acknowledged that, for an awfully long time, US markets have outperformed International markets — in fact, since 2009, 10 of 14 years by an average of 6.2% annually.

This kind of run, in general, is not sustainable. However, it’s always a question of timing, which is hard for anyone to reliably predict.

• USD Under Attack. The US Dollar’s reserve currency status is being challenged externally at every turn, by enemies and allies alike who are tired of being systematically disadvantaged on the economic global stage. And internally, through fiscal mismanagement and monetary hubris. Whether it’s excluding USD from settling certain trade flows, shying away from increasingly larger US treasury bond offerings, or the rise of digital currencies (both state-sponsored and crypto), on the margin the importance of the US Dollar and the luxuries it affords the US are waning. Admittedly, this is a slow-moving train, and it is difficult to foresee the US losing its reserve currency status any time soon. But for a US denominated investor, the impact of currencies is an important consideration when investing abroad — typically a meaningful portion of country-specific returns come from currency fluctuations. And a generally weakening USD from secular forces should be a nice tailwind.

For us, the reason to focus outside the US is more straightforward – a greater opportunity set. Simply

put, it provides more “shots on goal” to identify actionable inflection ideas that are investable. Why should the search for alpha stop at the US border? It shouldn’t, and for Validus it doesn’t. In August, we received another PSN Top Gun award for our flagship strategy, VG Global Growth, and achieved our 10-year track record with the #1 strategy since inception in our PSN category.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.