Rare Earths: Will China Play its Trump Card?

Despite the recent “detente” suggested by commentators and affirmed by the markets in the wake of a three-hour meeting between US President Biden and Chinese President Xi Jinping, we are skeptical of Chinese sincerity and confident in Washington’s gullibility (regardless of party in the White House).

We have yet to see any retaliation from the US decision to coordinate a worldwide curtailment of semiconductor chips and technology to China as a strategic decision to hamper their military ambitions.

A lack of response by China would be completely out of character and we anticipate they will retaliate.

How?

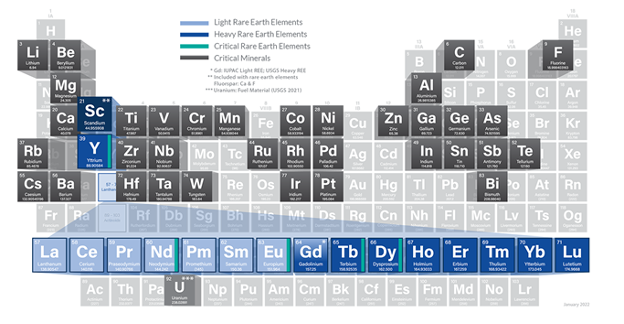

Enter rare earth elements (“rare earths”) – a group of 17 metallic elements in the periodic table.

Despite the name, these 17 elements are abundant – just not in concentrations that make extraction economical, hence the “rare” connotation.

Rare earths are fundamental to the tech economy – they are pervasive and essential in every meaningful technology that is expected to dominate the world going forward including EV batteries and magnets, metal alloys for military hardware and renewable energy, and industrial applications (to name just a few).

In the late 1980’s, Deng Xiaoping famously stated, “[t]he Middle East has oil. China has rare earths.”

For years, China’s industrial policies created an oversupply of these elements, driving down prices and causing most companies outside of China to give up on local production. Instead, these global companies were content to benefit from the resulting unsustainable prices, largely ignoring the substantial, largely undocumented costs (environmental, human) that resulted from these practices.

And while there have been some inroads made in diversifying global supply over the last 5-10 years, China still dominates production of these elements accounting for over 60% of global production in 2021 (down from 80+% or so five years ago).

More importantly, China controls most (reportedly 87%) of the world’s processing and refining capabilities. For example, the two largest producers outside of China, MP Materials (US) and Lynas Corp. (Australia), still need to ship most of their intermediate products to China for further processing – before being shipped back for ultimate sale.

And China has taken other steps to dominate this category, including:

- Making massive investments in R&D capabilities and human talent as reflected in its massive patent portfolio (almost double the runner-up Japan according to PatentManiac)

- Becoming the largest importerand consumer of rare earth products, effectively controlling both sides of the trade.

Recently, the strategic importance of these elements and the processing technologies has not been lost on the rest of the world both in public and private spheres. Two notable public examples are recent investments by the US Department of Defense:

- A $30 million investment in Lynas’ new refining facility in Texas in February 2021 for light rare earths and a follow-on $120 million investment in June 2022 for heavy rare earths

- A $35 million investment in MP Materials (the successor to Molycorp mentioned above) for heavy rare earth processing

Given recent rare earth prices, private capital has also been plentiful. However, these efforts may be too little, too late to break China’s grip on the rare earth industry.

While capital resources have been ample, the industry has yet to deliver at scale, especially on the processing side – indeed, the ultimate challenge will be to master the complex technical metallurgy in jurisdictions where environmental protection actually matters. According to Andy Mok, a senior research fellow at the Beijing-based think tank Center for China and Globalization, “the presence of China at every stage as both a monopoly and a monopsony…which makes it very difficult [for other countries] to significantly penetrate the supply chain.”

In our view, China’s nearly insurmountable lead in this area is ripe to be manipulated for political purposes. And, in the past, China has not been afraid to exercise their tactical and strategic muscles in this area – most of the time cloaking their intentions as they intermittently adjust supply and control pricing to meet their objectives. In 2010, China restricted supplies to Japan during a heated dispute over Senkaku/Diaoyu Islands. A few years later, they dumped supply on the global market at bargain prices (substantially below non-Chinese production costs) wreaking havoc on nascent producers — forcing many into bankruptcy including Molycorp in the US.

As we have seen in other industries like renewable energy, subsidies are only palatable for a limited time and eventually non-Chinese companies must stand on their own — finding ways to compete and sustain themselves in an ever-changing world consumed by political considerations and market forces. In the meantime, they are likely to have a substantial strategic “put” associated with their efforts as the Western world can hardly let their endeavors fail.

For our part, we are inclined to bet on the eventual, almost certain intervention by Chinese authorities in the intermediate term and the scarcity of non-Chinese production in the face of that pressure. Therefore, we favor using a calendar spread to implement this thesis – buying nearer term, slightly out-of-the money calls and defraying the cost by selling longer-term calls that are substantially out-of-the-money.

In the meantime, here’s some additional reading on the subject.

Will China Seek to Exploit Its Rare-Earth Dominance? | The National Interest

The West is rebuilding its rare earths supply chain—but China still looms large (yahoo.com)

Lynas awarded $120m DOD contract to build commercial heavy rare earths facility in US – MINING.COM

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.