Mark’s Musings: 11.16.22

Here Come the Electrified Semi Trucks. Where are we going to get the power?

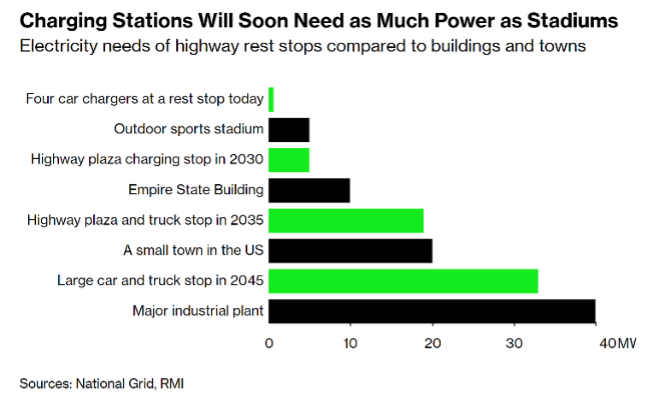

Tesla plans to deliver its first electric semi-truck next month. Unfortunately, there may be few places to charge it. “Researchers found that by 2030, electrifying a typical highway gas station will require as much power as a professional sports stadium—and that’s mostly just for electrified passenger vehicles. As more electric trucks hit the road, the projected power needs for a big truck stop by 2035 will equal that of a small town.” Apparently, the challenge is not having enough power in the aggregate (although we will certainly need more), but rather an issue of throughput at charging sites, delivering cumulative electricity at a specific place and time. Most existing substations will need to be upgraded and the process of permitting, approving, and building these sites is still in the stone age. Yet another example of enlightened headline policies that create incentives for clean energy adoption without addressing the operational and logistical challenges that prevent ultimate implementation.

Tesla’s Electric Semis Are Coming, and Trucks Stops Aren’t Ready – Bloomberg [Paywall]

Take It Out of the Oven – Crypto is Done for Most Investors.

How can we ignore what’s going on in the crypto world? As a recent Barron’s article put it, “[h]ow long does it take to wipe out a $32 billion company, shatter confidence in an entire industry, and leave a trail of destruction from Wall Street to Silicon Valley? In crypto, about a week.” What?!? Another crypto meltdown (and possible fraud) – this time at FTX, a beacon of responsibility in crypto land, the institutional community, and among the regulators? Who could have seen this coming? Maybe all the money spent lobbying both sides of the aisle on behalf of “responsible” crypto regulation that has never materialized should have been a tip off. This quote from our friends at BlueBay says it all: “It should have been clear that an industry that has been producing nothing, burning cash and offering alluring returns, was destined to fail.” Indeed, we wrote a blog back in September 2022 about the challenges adopting crypto in a portfolio allocation for most fundamental investors. After being told for so long that the rest of us weren’t smart enough to understand the crypto landscape, it turns out that many that jumped in with FOMO (fear of missing out) either didn’t do their homework or were as feeble-minded as the “dinosaurs” they scoffed at. Remember, we heard the same thing with “meme” investing – that the world had changed and the train had left the station for most of us, notwithstanding the scramble to apply actionable algorithms to Reddit threads. It may yet turn out that crypto has a place in the investing landscape, but it will take a meaningful period of time to overcome the skepticism of retail and institutional communities that have been burned again and again, even after regulations are implemented. That seems appropriate to us.

FTX’s $32 Billion Empire Has Crumbled, Spreading Damage Far Beyond Crypto. | Barron’s (barrons.com) [Paywall]

Big Investors Are Giving Up on Crypto Markets Going Mainstream – Bloomberg [Paywall]

Be Afraid. Be Very Afraid.

After many years of convincing its citizens that they should be very wary of COVID, it appears that Chinese authorities have succeeded. With a smaller city 160 miles from Beijing rumored to be easing up on COVID restrictions, people panicked – keeping their kids home from school, stocking up on traditional Chinese medicine and staying off public transportation. This reaction suggests that pivoting away from COVID-zero policies will be slow, incremental, and methodical – perhaps taking much longer for a return to normalcy than current enthusiastic investors expect. On the one hand, this should keep a lid on inflation. On the other, we will likely need to dial back our expectations that a return to growth in China will turbocharge the global economy, possibly even keeping us from entering a recession in the US and Europe.

End of China Covid Zero Rumor in City of Shijiazhuang Sparks Fear, Panic – Bloomberg [Paywall]

Turns Out that ESG Investing Can Be a Minefield Ripe with Contradiction. Surprised?

This article details a supposed darling of the ESG world – a company that sells cars and provides financing for underserved communities, such as for the undocumented. Seems like noble work. Except for an in-depth analysis by Barron’s that highlights the company’s business practices which seem to directly contradict the high standards that investors suggest made it a shining example of all that was good in the world. It’s the hubris that we find startling – in our view suggesting investors have no right to question the quality of ESG-related investment decisions if the overall intention is to “do good.” And, the notion that large institutions “have no choice” but to put money to work at scale (almost to the exclusion of other relevant facts) to demonstrate that they are following and supporting ESG principles. In our view, at best, ESG principles can be used in conjunction with other time-tested investing approaches. But to implement them solo — in and of themselves — seems rash and ill-conceived and primed to lead to less than stellar investment results.

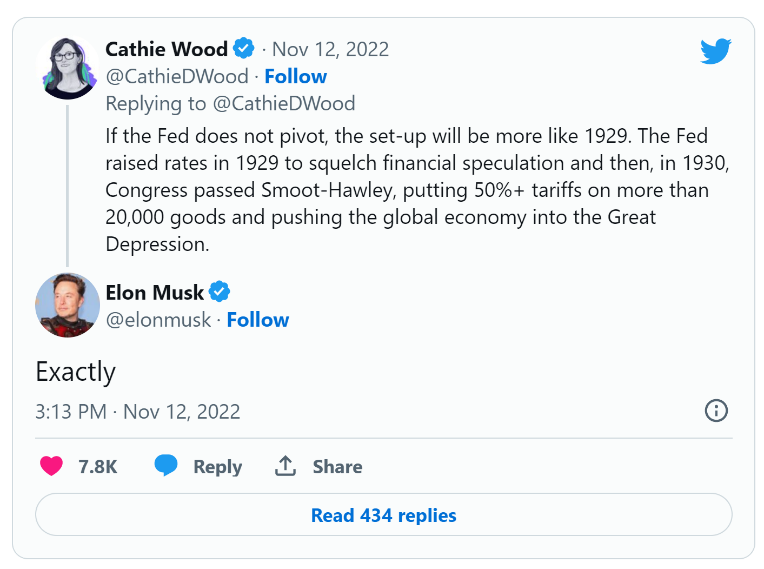

The Fed Better Pivot Now Says Cathy Wood. Elon Musk Agrees.

Could broad-based inflation really turn negative in 2023? While we are skeptical of comparing today’s economic circumstances to prior periods as a rationale (in whole or in part) for implementing an investment thesis, we think there is something to this argument. First, long-term we agree that the most important forces are deflationary – the result of living in the technology age. Secondly, we think inflation will come down quickly once it starts to recede, albeit settling at higher than 2% in the short-term. We wrote a blog about this – inflation is the last parabolic chart from the COVID era that has not corrected. Finally, for all the talk about data dependency, the Fed seems hell bent on getting to some magical rate number prior to even considering the impact of its policies. Remember, this is a Fed that has routinely mis-read the data and missed the mark – most recently in not tightening soon enough and assuming inflation was transitory. Suddenly they have it all figured out?!? Maybe a little humility is in order.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.