Mark’s Musings: 12.8.22

Trouble in Real Estate Land?

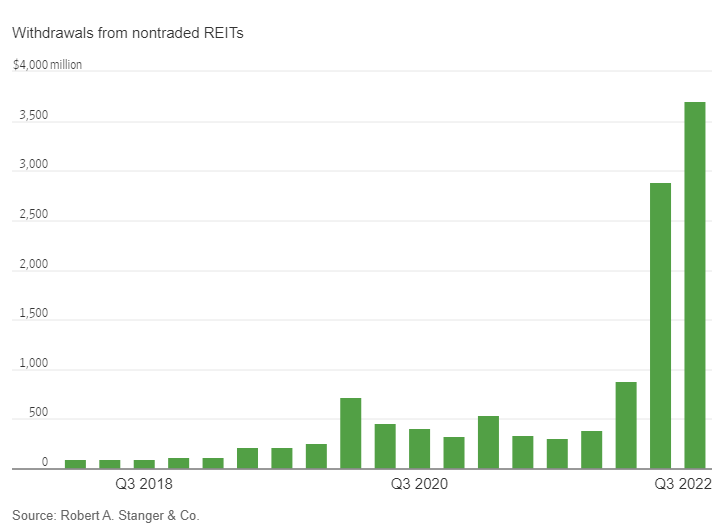

WSJ article highlights the fact that many non-traded REITs (including two of the largest and most high profile – Blackstone and Starwood) have “gated” redemptions due to requests that exceeded quarterly maximums. Why the sudden concern? Over the last six months, we’ve seen a major revaluation of public equities in general and public REITs in particular – public REITs are down 23.4% in 2022 (FTSE NAREIT ALL Equity REITs Index). Private real estate has largely been immune to this valuation adjustment brought on by higher rates. This makes sense since public markets typically anticipate financial conditions while private markets utilize lagging methodologies to assess the health of properties. However, negative sentiment seems to be finally catching up. As values have soared, absolute yields for real estate have declined to levels that no longer look attractive with “risk-free” three-month treasuries yielding 4.32%. Higher borrowing costs, which typically cannot be offset immediately with higher rents, impact cash flow generation. Assuming you can refinance your existing loan, that is — with the impending recession, many banks have backed away from commercial lending. Part of the redemption problem is also a function of the recent relative success — private RE has outperformed, and as a result, pension allocations are out of whack and must be pared back. Further, many investors have sought to exit before the valuation reckoning. “Appraisals look backwards, and markets look forward, and people are trying to arbitrage and get their money out before the write-down occurs.” according to Nori Lietz, a senior lecturer at Harvard Business School. If the pace of redemptions continues, private REITs may be forced to sell properties into a weak market to meet redemptions, putting more pressure on property values and requiring more sales – a vicious cycle. Just another reminder that private real estate is not immune to broader economic conditions and liquidity can never be taken for granted.

Everybody is Doing It -- Holding Performance Hostage Behind a Paywall

With the rise of electric vehicles – more than ever a computer on wheels — subscription-based, recurring revenue streams for car companies became a reality. Tesla was the first to recognize the possibility to charge for additional hardware functionality already built into the vehicle and to increase pricing as capabilities evolve through software updates. Currently, for “full” self-driving capabilities, it charges $99/month for Basic Autopilot and $199/month for Enhanced Autopilot – these features were originally accessed through a one-time $5,000 fee. Less capable versions of assisted driving like GM’s Supercruise and Nissan ProPilot Assist cost $2,500 and $2,000, respectively. Now, Mercedes wants you to “unleash enhanced performance for your car” – for a price. Namely, $100/month to unlock software that provides a 24% performance boost and adjusts the power and torque curves for their EQE and EQS sedans. Similarly, Polestar just announced an offer for its Polestar 2 sedan – for $1,195 drivers can add 68 more horsepower with a software update. BMW recently came under fire for seeking an $18/month subscription fee to use heated seats already installed. Have car companies taken things too far? We doubt it. How can any self-respecting performance enthusiast sit idly by and forgo additional performance that is lying fallow just beyond their reach? In the end, they may be bitter, but most will choose to unlock these features assuming they prove to be meaningful enhancements. Heated seats – not so much.

We’re Here to Help – Automation as a Trojan Horse?

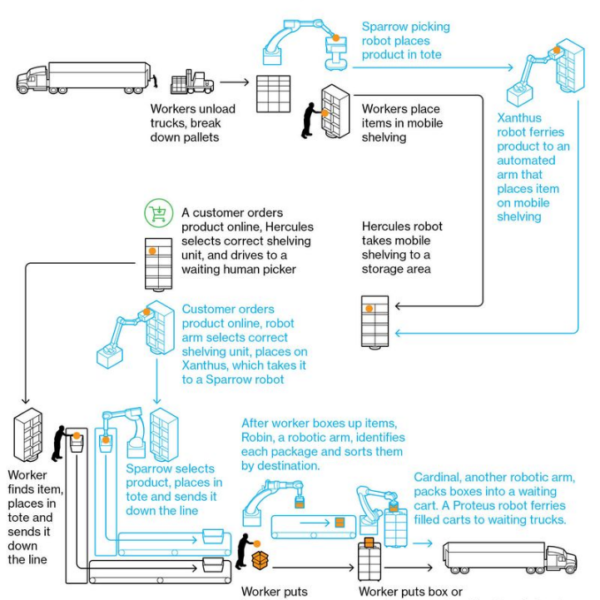

Amazon continues to push the envelope of efficiency within its warehouses. As labor gets more expensive and workers demand higher wages, more benefits, and even (gasp) unionization, the quest to fully automate its fulfillment process has reached a fever pitch. Yet, despite many years of effort and billions of dollars spent, the Company still relies on hundreds of thousands of people, as engineers have struggled to duplicate a human’s manual dexterity. Now Amazon seems to have found a solution, “a highly automated system featuring a yellow robotic arm that the company says can pick up millions of types of products without crushing or dropping them. The new bot’s name is Sparrow.” While the technology will take years to perfect and roll out, it will eventually lead to fewer people being employed in its warehouses – largely small teams of specialized technicians. Of course, the company can’t say that. Amazon, like most companies, claims the aim is not to replace workers, but to help them — “freeing up workers for more stimulating tasks….” Nonsense. In our view, it’s just a matter of time – time to work out the kinks, stress-test the equipment and procedures and train the AI. Workers get tired, get injured, demand higher wages, better working conditions, and greater benefits and (in today’s world) often quit – robots do not. We think this in part explains why employment has stayed so strong in the face of a slowing economy – the benefits of automation are not achieved overnight, and employers are not going to risk losing hard-won employees in a hyper-competitive environment until they are absolutely sure the new technologies work flawlessly. These processes are inherently deflationary. Looking into the future, wage pressures and worker shortages may give way to stubborn unemployment and disappointing wage growth. Time will tell.

Taiwan as the Potential Flashpoint in the Battle for World Supremacy

Because of its importance to the semiconductor world, Taiwan is at the center of the strategic battle for dominance between the US and China. The article discusses Tuft’s professor Chris Miller’s new book, “Chip War: The Fight for the World’s Most Critical Technology”, which argues that the world is underestimating the risks of a negative outcome in Taiwan. How did we get here? First, it’s hard to underestimate the importance of chip technology in today’s modern world, especially as applied to sophisticated military functions. Only recently have we come to grips with the reality that the connection between advanced computing and military power is inextricable and not just a luxury that allows us to upgrade to the latest iPhone. Second, pioneers like Morris Chang who started Taiwan Semi and stepped into a breach created by the drive to “outsource” the delicate and capital-intensive task of manufacturing chips in favor of controlling the design and architecture through software. It’s this company-specific success, perhaps unprecedented and possibly the most underappreciated achievement of the technology age, that created a chokehold on the most advanced chip technology and the resulting global supply chain. The author estimates that it would take 5-10 years to replace Taiwan’s capacity if it came offline and the economic impact could be greater than what occurred during the COVID crisis. Perhaps we should all be paying closer attention to this potential flashpoint.

Is Tik Tok a Security Concern? What the FBI is Voicing What Parent’s Already Knew.

This administration spends great time, effort, and money criticizing US companies for their technological superiority, preventing them from acquiring other firms, and using every tool in the regulatory shed to derail their success. Not that we should give any of these companies a free pass. However, the US government is very close to cutting a deal with a Chinese company, ByteDance Ltd., to allow it to continue to operate in the US – a company that inflicts the same implicit harm for which US companies are vilified and could inflict more explicit damage if it so chooses or is required to do so. The FBI has some concerns on a national security level which Christopher Wray related to lawmakers a week ago. Wray stated, “Under Chinese law, Chinese companies are required to essentially — and I’m going to shorthand here — basically do whatever the Chinese government wants them to do in terms of sharing information or serving as a tool of the Chinese government…that’s plenty of reason by itself to be extremely concerned.” Why is a deal even on the table at this point? The article related that “[Tik Tok] [has] become key to reaching young voters, who are increasingly eschewing social networks such as Facebook and Twitter.” Ah, there’s the rub.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.