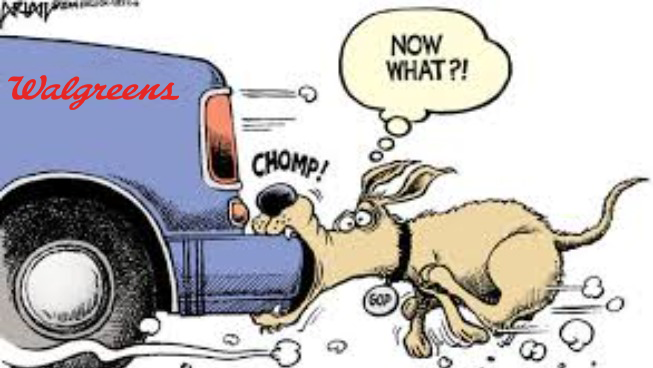

The Walgreens’ Debacle: Dog Catches Car

Late last week, investors got a surprise when Walgreens Boots Alliance (TKR: WBA) announced that it would be slashing its dividend by 50%. Perhaps this news should not have been so surprising because, immediately prior to the cut, the dividend yield was a colossal 7.5% — nose bleed territory for a run-of-the-mill operating company. In fact, as recently as the end of September, the dividend yield hit a high of 8.6%. Back in March 2022, we discussed the dangers of higher yielding stocks in a blog (HIGH YIELD CAN MEAN CAUTION… OR HIGH OPPORTUNITY). We posited that, for stocks trading at such high yields, a Rubicon had likely been crossed that would require resolution:

- Price moves higher to reflect a market mispricing of risk and/or opportunity. The stock moves higher, and the current distribution generates a lower current yield.

- Dividend distribution is cut to reflect more realistic underlying fundamentals and the current yield moves lower.

- Combination of a higher price move and a cut to dividend distribution.

- Current yield moves higher as the price declines further placing even more pressure on management to cut the distribution. The classic “value trap” just because something is “cheap”, doesn’t mean it can’t get cheaper.

Why is it important how the dividend aristocrat lost its royal crown?

First, because it comes on the heels of decades of dividend increases. WBA was dividend royalty — not just a Dividend Aristocrat (25+ years of dividend increases) but a Dividend King (50+ years of dividend increases)! Secondly, because part of the stated allure of focusing on these kind of dividend payers is that no matter the fundamental deterioration of the underlying business, most companies will be deathly afraid to lose their status by cutting its dividend. As a result, it is posited that a dividend is stickier, less volatile and more reliable than fickle earnings streams. Until it isn’t. As happened with WBA, a company’s dividend regime can become so disconnected from the underlying operating performance of the business that only drastic action can rectify it. Only then is it obvious that the “emperor” was never fully clothed.

Lots of Wall Street sell-side analysts praised the move under the auspices of “clearing the decks” for the new management team and putting the company back on the road to repairing its balance sheet. Some have estimated that this could save the company $800 million annually. All the more important, since in mid-December, Moody’s downgraded Walgreen’s credit rating to junk status (from Ba2 to Baa3). In fact, WBA nearly doubled its total debt to $33.7 billion since the end of 2019 (pre-COVID). Nonetheless, the company continued to raise its dividend during this period.

A terrible outcome for current income-oriented holders.

Don’t get us wrong, this seems like a necessary move for a new management team that’s looking to put the company on a more solid footing for the future. However, it’s a terrible outcome for current income-oriented holders who relied on the impeccable dividend history (too heavily in retrospect) as a “good housekeeping seal of approval” despite several years of post-COVID lackluster fundamental performance. The stock was down as much as -11.5% intraday on the announcement and finished down -5.1% for the day.

Even more confusing, this change came on the heels of a fantastic December in which the stock soared 31%. Some of this enthusiasm related to a sentiment shift that favored selling the YTD “winners” and buying the YTD “losers” (Walgreens was firmly in the latter category, down -43% YTD through November). But also due to some sector-specific and company-specific optimism. Walgreens tangentially benefitted from an announcement by CVS that it is changing its pharmacy business model with respect to pharmacy benefit managers (PBMs) for prescription drugs. CVS proposed a novel, yet simplified model based on the cost of the drug plus a set markup. The hope is that this will relieve margin pressure and uncertainty for retail pharmacies across the board should PBMs agree to the change. Investors are hoping that Walgreens will adopt a similar model. The company also suggested that it may be divesting its Boots UK subsidiary, a continued drag on results.

Management continues to caution that 2024 will be a difficult year.

After all, in some cities, they are still locking products behind plastic cases to prevent rampant theft that has impaired sales and margins. As a result, WBA management lowered its comparable sales guidance for 2024 from “flat” to down single digits. At least in one sense, we applaud the courage of WBA’s CEO in taking the difficult road – admitting that at least 50% of historical dividend increases were merely for show and could not be sustained by the current business.

Let this episode be a useful reminder.

A growing dividend can be an accurate reflection of a healthy business – assuming it is properly covered and paid for with concurrent cash flow generation. Or it can be the result of financial engineering in which ever larger ”headline” payouts are funded with higher and unsustainable debt levels and/or by slashing R&D / capex thereby imperiling future growth.

The moral of the story.

Fundamentals matter, especially if you’re chasing yields. Because just like the proverbial dog chasing a car, you just might catch it.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.