Say Goodbye to Pricing Power and Hello Purchasing Power

The ubiquitous pricing power of many companies throughout COVID and beyond is finally coming to an end. In the Fed’s January Beige Book (Federal Reserve Board Publication), there were indications that continued price increases were being met with resistance across the country:

- National – “Districts also noted that increased consumer price sensitivity had forced retailers to narrow their profit margins and to push back, in turn, on their suppliers’ efforts to raise prices.”

- Philadelphia – “Several small businesses observed that customers’ resistance to higher prices increased further. For some firms, profit margins narrowed as food commodity costs remained volatile.”

- Kansas City – “Food retailers were reportedly much less willing to accept higher input prices from distributors. In particular, grocers pushed back on their suppliers, citing concerns about their ability to pass cost increases onto customers.”

Transforming sluggish volumes into what looks like “revenue growth”.

Last week it was reported that the French grocery chain, Carrefour, would stop selling PepsiCo products due to “unacceptable price increases.” PepsiCo countered and said it was their decision to pull out. While likely the result of a negotiation gone bad, pressure is mounting on companies worldwide to be more transparent and less greedy – and everyone from consumer advocates to politicians are making their voices heard. E. Leclerc, a competing European grocery chain, has taken suppliers to task over LinkedIn. For its part, Carrefour has been warning customers of the sneaky tactics of suppliers by posting labels on products where weight or volume has decreased while the price has increased.

Availing themselves of the cover of issues created by the COVID pandemic – supply chain and logistical snafus, higher wages and input costs, and a general inflationary environment – many have been able to transform soft fundamental performance from sluggish volumes into what looks like revenue growth. And by continuing to keep prices high, or by delivering less product for the same price (“shrinkflation”), margins have improved as inflation has rapidly dissipated. Pretty neat trick if you can get away with it. Barron’s reports that in Europe PepsiCo’s blended prices were up 13% in its fiscal third quarter of 2023 with similar volumes and “voila” up 13% organic growth in net sales! Conveniently, margins also expanded by 82 basis points.

Snack volumes have fared much better.

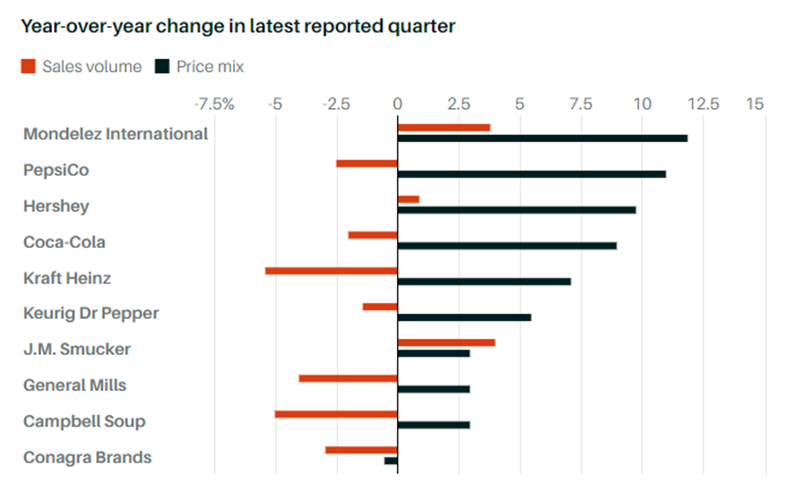

Even as prices have risen across the board, snack volumes have fared much better than more traditional food staples. As the chart below indicates, companies like Kraft Heinz, General Mills, Campbell Soup, and Conagra have seen their volumes drop more even though they have taken less price.

Snack food companies have demonstrated more inelasticity, with some like Hershey, JM Smucker and Mondelez actually growing volumes along with price. Are Oreos and Doritos really more of a staple than a cup of soup? Tempting to say yes – especially during college years! Maybe, with our rapidly changing consumer tastes, our definition of what behaves like a “staple” must be constantly reassessed.

Pricing Power vs Purchasing Power.

College Econ 101 teaches a concept called price elasticity of demand. Essentially, it’s a measure of how sensitive demand is to changing prices. Grocery staples – everyday necessities – are assumed to be very inelastic, meaning that changes in price have little impact on demand. The lesson here is, paying more and getting less can extend far beyond reducing your purchasing power at your local market to the price you pay in the stock market. That is, if you don’t understand the fundamentals.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.