Tesla’s Not So Typical Recall

We were interested to see Tesla stock drop intraday on December 13th with the announcement of a two million car recall of Tesla vehicles – largely its entire existing fleet. Especially, having recently written an article on electric vehicles about how some of Tesla’s advantages relative to its competition titled, Trouble in EV Land? It Depends on Your Strategy.

Typically recalls – especially of this magnitude — can be costly endeavors for automakers and generally lead to questions about quality of the product and ultimately the brand. But such a kneejerk reaction suggested that at least some market participants (quant models?) don’t really understand why Tesla is different. It was encouraging that after investors (humans?) had a chance to assess the situation several hours later, the stock recovered its losses and finished slightly higher on the day.

We saw the Tesla recall as a positive event – first, because it would seem to get the NHTSA off their back (at least in the short-term) with respect to questions regarding its autonomous driving system, and second, because it demonstrates the power of Tesla’s business model. Increasingly, autos are a software platform. Tesla was the first to see this and capitalize on it. In fact, Elon Musk has stated that ultimately, most of Tesla’s profit per vehicle may be derived from recurring / subscription revenue after the sale, rather than at the point of sale.

From the start, Tesla reimagined the ways a car company does business — no dealer network; very little advertising spend; writing their own software code; and vertical integration. Let’s reflect a bit on what Tesla has achieved with Autopilot. It has been able to roll out a largely autonomous system without NHTSA pre-approval while having their customers test the system, provide instant feedback, and pay for the privilege. Along the way they have accumulated the largest dataset in the autonomous driving space, perhaps putting them years ahead of their competition again. This is just one of the examples that makes Tesla a disruptive innovator in identifying market inflections early and subsequently getting ahead of the would-be competition.

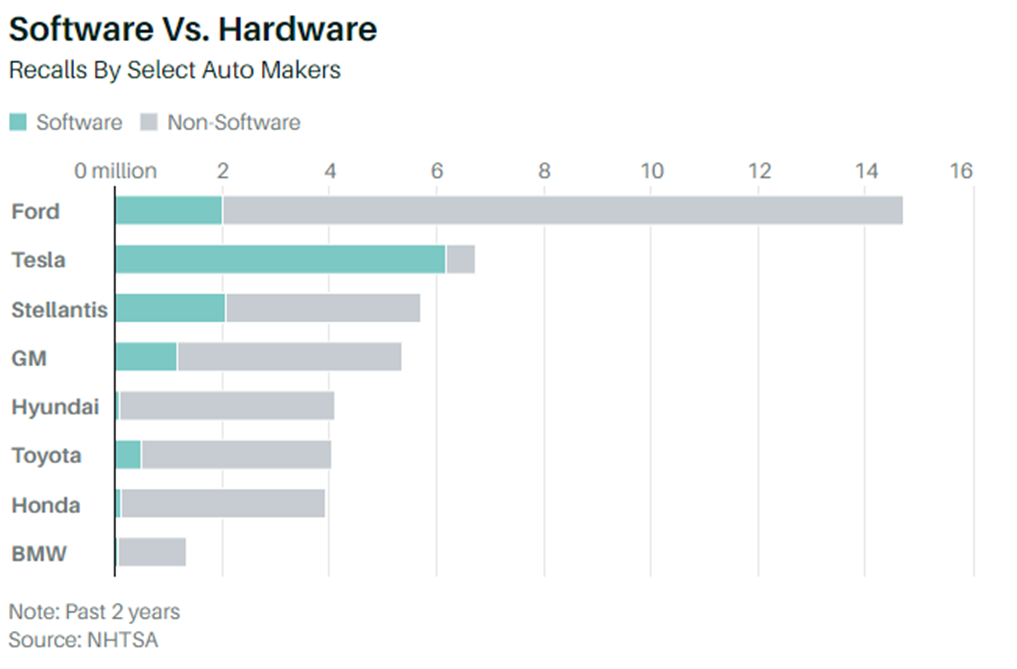

We were further heartened to see an article that appeared in Barron’s on Monday of this week (Tesla’s Massive Recall Explained in Three Charts). This short, well written piece from Al Root demonstrated the Tesla recall, and previous recalls, were a different animal that warranted a closer look. On the surface, it would appear that Tesla has more recalls than its peers — more than 15% of total with roughly 1% of total cars on the road. Sounds disturbing. Until you realize that over 90% of these recalls were software related and not the result of faulty hardware.

This recall – the supposedly largest ever – involved “…updating software controlling warning signals for Tesla’s driver assistance features to better ensure its systems won’t be misused.” For all other automakers taken as a whole, only 16% of recalls related to software, many of which still required a trip to the dealer and an appointment with the service department to remedy. Tesla can address such issues automatically with a software update over a cellular network that occurs seamlessly and without effort on the part of the driver, ensuring higher compliance. We would venture to guess that most Teslas have already been updated.

First reactions aren’t always the correct ones. Especially when it’s about a disruptive innovator doing what they do. And one thing is for sure: The Tesla’s recall is no typical recall.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

The Validus Pure Alpha and Inflection Folio strategies, as well as the Destra Multi-Alternative Fund that Validus sub advises, invest in TSLA. Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.