Trouble in EV Land? It Depends on Your Strategy.

Recently, and seemingly out of nowhere, the markets have turned sour on EVs. Remember all the auto makers stumbling over each other to be the first to promise an all-electric future and show their reduced carbon footprint bona fides? The bandwagon included Volvo, Mercedes, Jaguar, Cadillac, Rolls Royce, Alfa Romeo , among others, committing to be all-electric by 2030. Even Ford, GM, and Stellantis promised at least 50% EV sales by 2030. Ah…not so fast!

Enter higher rates generating larger monthly payments, lower prices on slower demand and increased competition, greater supply, and a general lack of infrastructure. Despite recent price adjustments, EVs are still more expensive up front. First movers (some would say “true believers”) have already purchased one or multiple EVs. Now the industry must convince the next generation of EV buyers – maybe it’s not a surprise that Tesla is toying around the edges of traditional advertising.

Recent signs of trouble are ostensibly everywhere:

- In its 3Q earnings release, Mercedes Benz blamed “intense price competition, particularly in the electric vehicle segment” for lower expected free cash flow for the year.

- Ford announced that it is postponing its $12 billion EV factory in Kentucky. In the latest quarter, Ford lost $1.3 billion on its EV effort and expects to lose $4+ billion for the year. Some estimates suggest that Ford is currently losing upwards of $60,000 per EV!

- General Motors (GM), which for years has touted its all-electric future, indicated in its 3Q earnings release that it is scaling back near-term production target, abandoning the 100,000 target for the second half of 2023. Further, GM is delaying a $4 billion overhaul of a Michigan factory that will make EVs.

- Polestar cut its guidance for current year and 2025 deliveries, will focus on cutting costs and will have to raise additional capital – at least $1.3 billion – to get to cash flow breakeven in 2025.

- Tesla’s Elon Musk lamented on its earnings call about higher interest rates and a slowing economy impacting demand. Through last Friday, Tesla stock was down -5.9% so far in 4Q 2023 vs. the S&P 500 Index up +6.6%.

Even the auto-focused chip makers have gotten hammered. ON Semiconductor recently provided weak 4Q guidance and the stock tanked -22% immediately thereafter while battery-maker Panasonic cut in full-year 2024 sales outlook and promptly fell -9%.

Could it be that billions invested in the EV dream is impairing cash flow and enterprise value, rather than enhancing it? Maybe it depends on who you are.

The Old Guard — Even though they were quick to throw their ICE (Internal Combustion Engine) businesses under the proverbial bus and were lauded for it, Ford and GM continue to lose money hand over fist – so much so, that GM doesn’t even report the specifics. Outwardly, they say they are not daunted by the massive losses and less than stellar reception their new products have received from buyers. Internally, they seem to be quietly scaling back their ambitious roll-out timelines. These transitions are likely to take longer and have more twists and turns than originally anticipated – there’s a big difference between strategy and execution. The degree of difficulty is higher as both GM and Ford are saddled with legacy capital plants and limits to implementing automation due to their unionized labor forces.

The New Upstarts – Whether it’s Rivian, Lucid, Polestar or others, growing pains abound with very disparate results. Rivian’s two-pronged strategy has benefitted from a delivery vehicle partnership with Amazon that has provided assured demand. Lucid just lowered guidance. Fisker just announced accounting irregularities. All will need more capital. Vietnamese newcomer, Vinfast, briefly captured the attention of meme stock investors in August after merging with a SPAC, spiking to over $93/share before settling back to roughly $6.50/share currently. Besides aggressive aspirational expansion plans for the US, it’s hard to see a fundamental reason for the excitement.

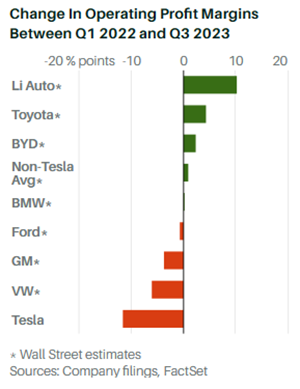

Chinese Competitors – China is the biggest EV market in the world and it is hypercompetitive. Generally, homegrown, and subsidized producers like BYD, SAIC, BAIC and Geely dominate this market. Since 80% of global EV battery production occurs in China, Chinese auto makers benefit from the ability to source the single most expensive component cheaper than their international peers. As a result, they have focused on lower priced EVs starting below $30k, although a substantial portion of their sales are actually hybrid vehicles rather than pure EVs. In our view, Li Auto is the most interesting – it has gained the most market share over the last 12 months, is employing a novel product strategy. Li calls their EVs range-extended electric vehicles. They incorporate a gas-powered generator on board to recharge the battery on the fly if the battery gets low–sort of like a plug-in hybrid, but without the additional engine or transmission. This eliminates range anxiety while lowering the cost of vehicle production.

The Market Leader — Tesla has been lowering prices, igniting pricing wars in the US just as investors have gotten comfortable that a truce had been reached in China. This is likely a longer-term market share play and Tesla has the margin to give, although investors usually flinch when public companies talk about lower margins. Elon Musk wants to make things as painful as possible for the legacy automakers and new entrants to stay the course in the face of higher capital costs. RBC analyst, Tom Narayan, suggests this pricing strategy could be part of a “master pivot” from being a “volume car maker to becoming a Tier 1 supplier to [auto makers]” including supplying power trains, batteries, charging infrastructure and self-driving technology. Intriguing take. Finally, the UAW promises its coming for Tesla next — Elon Musk says bring it on.

The Cautious Followers — A small group of auto makers have taken a more measured approach to EV adoption. Toyota is considered the poster child and has resisted completely buying into the EV hype, despite the pressure from investors and global climate change activists alike, perhaps not surprisingly, because of their historical hybrid dominance and relative market share. However, from the start, they have contended that a range of options for consumers and enterprise customers is the best path. As a result, Toyota has focused on driving innovations across its product range, including more efficient, less polluting traditional ICEs, hydrogen-based ICE variants, and a new EV platform that it claims will double current driving range and will be “entirely different from those today.” That said, earlier this year, the new incoming CEO announced 10 new EV models and a 1.5 million vehicle target for all-electric sales by 2026. This strategy has been described as “defensive” — we suggest that it might be just right. Toyota recently pointed out to its dealers the challenges with an all-electric future including (a) constraints on critical raw materials and supply chain issues that will limit production; (b) a lack of public fast-charging infrastructure in most markets globally; and (c) prices that will remain high for consumers for the foreseeable future.

Today the EV industry has neither the material supply to meet collective production goals, nor the charging infrastructure required to bring the initial cost and cost of ownership in line with traditional ICE vehicles without subsidies. Until resolved, this will impact demand from the next generation of buyers. In short, we are pretty sure that the future will look different than most rosy predictions forecast. Like most things, the devil is in the details in terms of strategy and tactics, and we would rather look to actions over words in getting a lay of the competitive landscape.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Sources: Bloomberg, Validus Research

The Validus International strategy invests in Toyota (TM), and the Pure Alpha strategy invests in Tesla (TSLA). The Destra Multi-Alternative Fund that is sub-advised by Validus holds options in TSLA. Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.