Out of the Frying Pan, Into the Fire

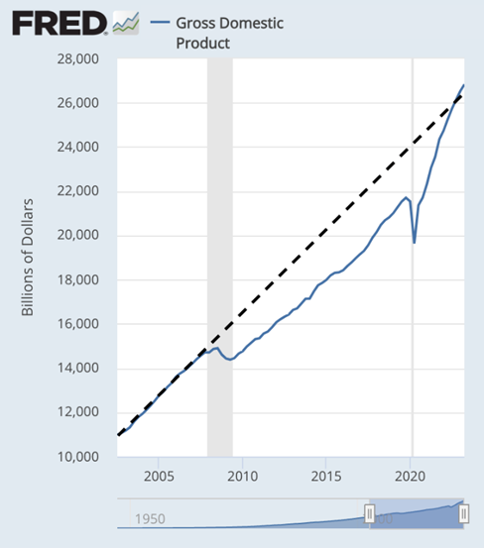

We’ve recently seen what’s being called “frying pan” charts entering the economic lexicon. The “handle” of the pan being on the left prior to 2008 and the “pan” being on the right side post financial crisis (with a little additional dip during COVID). Of course, this pattern has been obvious for years, but doesn’t seem to have gathered much attention until recently as far as we can tell. So, why now?

I guess we should start with what these charts are trying to tell us using FRED’s historical GDP chart as an example. I think it’s fairly clear – the financial crisis was brutal and had a lasting a meaningful impact on the economy in many ways. Eventually, though, the economy has returned to its pre-financial crisis growth rate.

But maybe there is more. According to Paul Krugman, a so-called “leading liberal voice in American policy debate”, in an OpEd in the New York Times on August 1st (Opinion | The U.S. Economy’s Lost Decade), it’s evidence that not enough fiscal support / stimulus was provided after the financial crisis. His proof? The COVID experience, which demonstrates what’s really possible when both fiscal and monetary policy is unloaded on the economy with both barrels. He argues that with the right policies the US economy should have returned to firing on all cylinders (i.e. full employment) by the middle of 2011 instead. The cost? $4.5 trillion in GDP in today’s prices. Maybe there were other factors at play, like the increased regulation of banks that led to increased and higher-quality capital requirements, impairing the industry’s ability to provide capital for growing businesses at the same rate and magnitude. Just saying. Interestingly, over this same period (12/07 – 6/23), bank stocks, as represented by the KBW Bank Index (BKX), underperformed the S&P 500 Index by 274% on a cumulative basis (BKX 46% vs. SPX 320%), according to Bloomberg.

Of course, Mr. Krugman is a top-notch, accomplished academic – a Nobel Prize winner in 2008 no less. We are not. But the timing of the article struck us as interesting. That evening, the rating agency, Fitch, downgraded the US credit rating from AAA to AA+. A coincidence? Perhaps. But we can’t help but wonder if he had sniffed out the Fitch downgrade and was taking pre-emptive action to head off the almost certain cries from economic political opponents to address the almost unchecked fiscal deficit spending that we’ve all accepted as the normal course. Remember, in May 2021, he told Insider that he was “farther left” than the Modern Monetary Theorists, who according to Investopedia, believe in “a macroeconomic theory that says that countries that control their own currencies, like the US, are not constrained by revenues when it comes to government spending.”

For us, it’s hard not to see an eventual day of reckoning for the US economy, especially if we continue to take our economic and monetary advantages for granted. However, we do not see this as imminent. Rather, it is likely to happen gradually (like a slow-motion train wreck) as other economic competitors look for ways to avoid and undermine the USD for international trade at every turn while remaining a reluctant buyer in larger and more frequent US debt offerings.

In the short run, with interest rates substantially higher, borrowing costs are rapidly accelerating as a percentage of the total US budget. With the political stalemate in Washington, it is likely that the Fed will have to step in earlier than expected with monetary accommodation to make these costs manageable. So far, Chair Powell has deftly avoided commenting on unchecked fiscal spending — essentially treating it a passive input in its monetary calculus. To us, this stance will quickly prove untenable as we enter the presidential election in 2024.

So, if the frying pan is where we’ve been and the fire is where we’re going, what would be the next investment move? Fortunately, dislocations are always good for those searching for alpha. With a proven process, all things are possible.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.