Market Breadth, or Another Head Fake?

Over the past couple days, market breadth has been impressive, with the S&P 500 Equal Weighted Index up 3.3% vs. the S&P 500 Index up 2.1% vs. the Magnificent Seven up 1.6% (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA). Could the M7’s reign be coming to an end?

Two days does not a trend make.

But that didn’t stop the pundits from making the rounds and talking their book – Value is the new king in town! Remember, these are the same folks who suggested, starting back in the beginning of 2021, that Value’s reign was just beginning, and we could look forward to 7-10 years of dominance over Growth. That reign lasted about seven months with Growth (Russell 1000 Growth Index – RLG) outperforming Value (Russell 1000 Value Index – RLV) by 4.0% for 2021. Then, the Fed started raising rates aggressively suggesting that growth had to be discounted back to present at something other than 0%, and therefore high multiple stocks had to be repriced. And they were – RLV outperformed RLG by 20.6% in 2022. With rates much higher, this had to continue into 2023 and into the foreseeable future, correct? Nope. So far this year through 11/15/23, RLG has outperformed RLV by 32.9%. For those keeping score at home, since the beginning of 2021, RLG has outperformed RLV by 6.4%.

Just to put in perspective once again (we wrote another blog about it back in May – Top Heavy Performance) what an unusual circumstance we have found ourselves in this year. This week, Goldman Sachs pointed out how the so-called “Magnificent Seven” (top 7 stocks in S&P 500 Index in terms of market capitalization) has skewed the S&P 500 Index’s returns. Most portfolio managers today have never seen such a market, let alone been positioned for one.

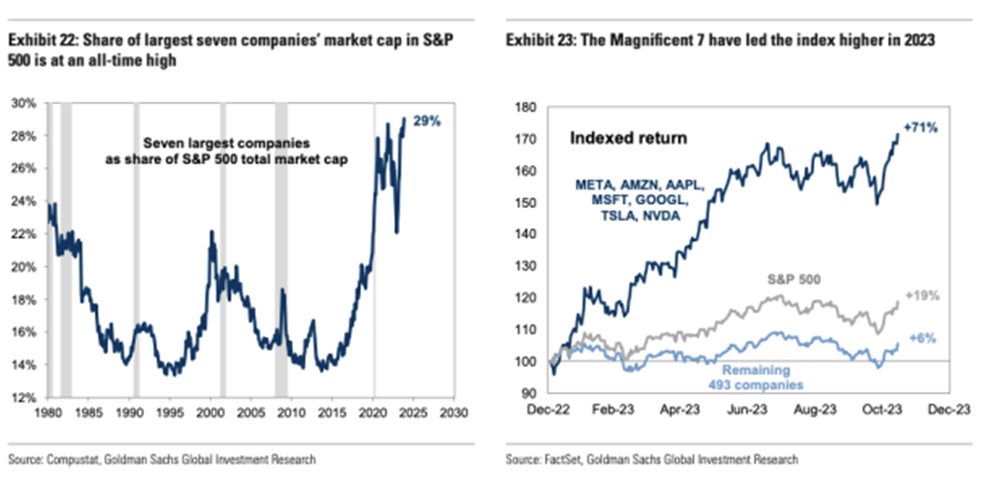

In 2023 YTD, the Magnificent Seven is up 71%, while the remaining 493 companies are up 6%, which has resulted in an overall S&P 500 return of 19%. Understandable, since the S&P 500 Index is a cap-weighted index.

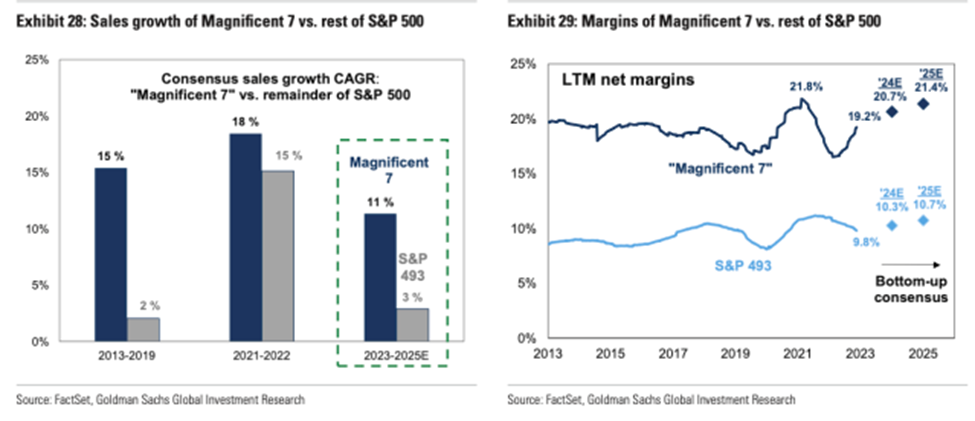

Further, since 1980, the concentration in top seven stocks of the S&P 500 Index is a record 29% of total market capitalization. Why? Because that’s where the expected growth and margins are.

But can it last?

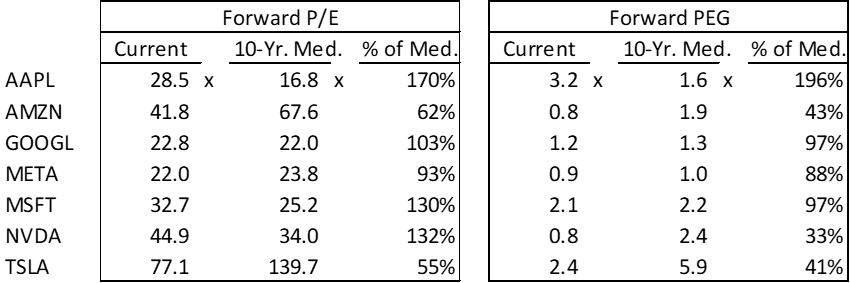

From a sentiment perspective, many believe that what’s already worked in 2023 will continue to work for the rest of the year. From a valuation perspective, even though mega cap tech is expensive – the Magnificent Seven have Forward P/Es between 22-77x vs. the S&P 500 Index’s 21x – not so much when expected growth is factored into the equation. All but Apple (at 3.2x PEG Ratio, 196% of its 10-yr. median) are relatively cheap “to themselves” at between 33-97% of their historical 10-yr. median PEG Ratios.

In fact, Validus owns most of the Magnificent Seven across different portfolios except for Apple (AAPL), whose growth is decelerating, and Amazon (AMZN), which is expensive on an absolute basis. But nowhere near the concentration within the S&P 500 Index. Further, we own lots of other names where growth is reflecting.

No doubt, the total number of stocks that are increasing in price has been impressive. In our opinion the Magnificent Seven is a kind of head fake. There’s is no need to get too top heavy, especially when there are plenty of opportunities without the nomenclature.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

The Destra Multi-Alternative Fund that is sub-advised by Validus currently invests in MSFT, NVDA and TSLA. In addition, individual Validus strategies invest as follows: Rising Dividend Strategy invests in MSFT; Global Growth strategy in GOOGL and META; and Pure Alpha Strategy in TSLA. GOOGL, META and TSLA are also included in Validus Structured Note Products. Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.