Does the Way Small Businesses Feel Matter? Probably.

The recent NFIB Small Business Optimism Index (the “SBO Index”) from July revealed some interesting information.

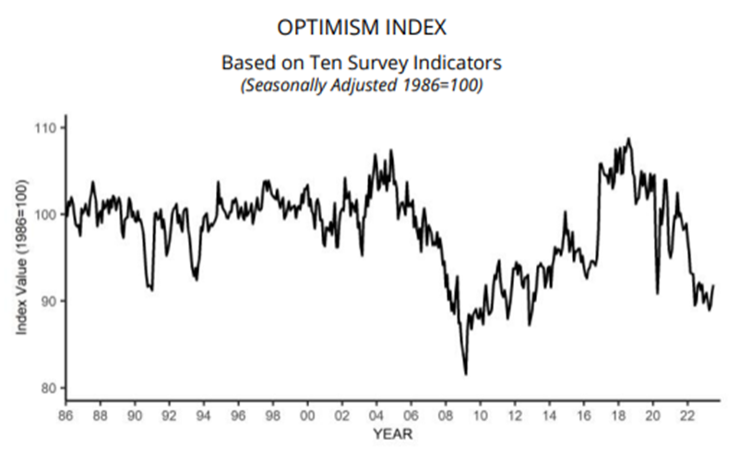

The index is part of a survey of small business economic trends from members of the National Federation of Independent Business (“NFIB”), implemented monthly since 1986. It’s a composite of ten components and is meant to provide an indication of the overall health of small businesses in the country.

Although the SBO Index increased 0.9 of a point to 91.9 in July, this is the 19th consecutive month below the historical (49-year) average of 98, dating back to December 2021.

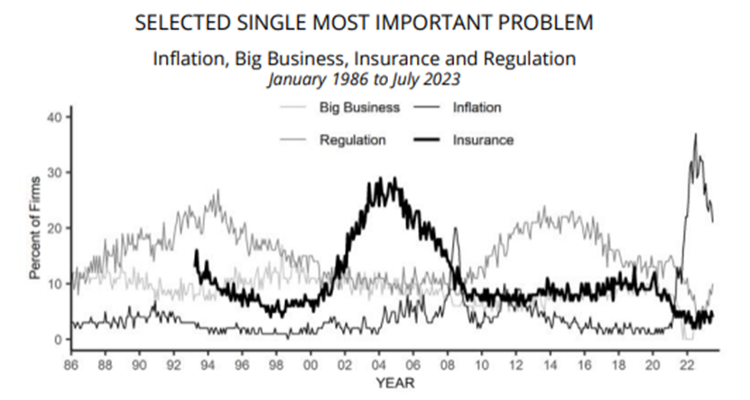

Certainly, inflation — largely in the forms of higher wages and input costs — has been difficult for most small businesses, who do not have the pricing power of the big brands nor the marketing and operating leverage to push through price increases without impacting volumes. And the data bears this out – the chart below shows that inflation is still the single biggest concern.

Is increased regulation starting to take its toll?

We call attention to a meaningful uptick in regulation as the single most important problem above. And it’s rising as inflation declines. Our friend, Victor Canto of La Jolla Economics, speaks about this issue and its underrated impact on economic activity frequently. For small businesses many well-intended policies designed to create greater competition and prevent the big guys from taking advantage of their sheer size end up having exactly the opposite effect. The large companies have the time, talent, and resources to take on additional compliance requirements without missing a beat. For smaller companies, a more burdensome regulatory regime can often lead to extinction events, either immediately or over time.

Take the example of the implementation of GDPR (General Data Protection Regulation) rules in Europe that sought to address data ownership and privacy, largely in the wake of the 2018 Cambridge Analytica scandal in which Facebook user information was shared and used to inform political campaigns. While we applaud the European community for being out front in addressing such complex and important issues, these new rules seem to have had a disproportionate impact on small business.

According to a study by Giorgio Presidente and Carl Benedikt Frey of Oxford in March 2022 (The GDPR effect: How data privacy regulation shaped firm performance globally | CEPR), the implementation of GDPR caused an 8% reduction in profits and a 2% decrease in sales for those companies exposed to the new regulations. And this burden was borne almost solely by small and medium-sized businesses, with no discernable impact on the big guys that the rules were supposed to address. The authors conclude that, notwithstanding some of the limitations of the study, “…some modifications to GDPR in its current form would be desirable, taking into account that the regulation has put smaller companies at a disadvantage. Indeed, while European leaders have pledged to reign in the power of big tech, GDPR might even have strengthened them by weakening their competitors.”

Regulatory Regime Changes can be meaningful in identifying or eliminating potential growth opportunities which is why they are is an important research category in our search for Market Inflection (Invest at the Inflection Point of Accelerating Growth).

As rules of the game shift, will incumbents adapt, grow stronger, or be left behind?

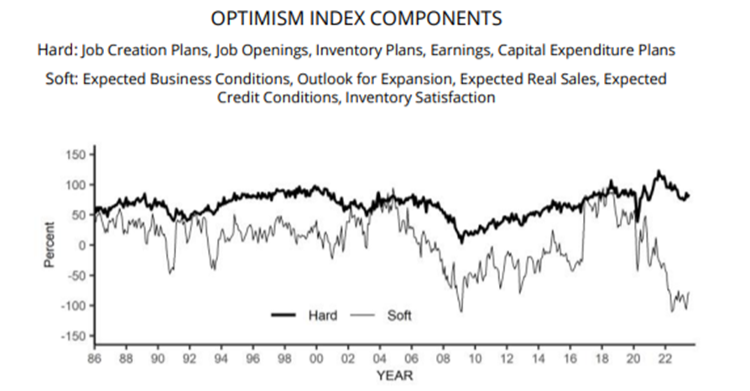

Here is an intriguing chart showing the “gap” between so-called “hard” index components (usually backward-looking): GDP, employment, corporate profits, etc. and “soft” index (usually forward-looking): durable goods orders, consumer confidence index, etc.

This pattern is the same as we are seeing for economic activity in general, which is causing such confusion among economists about where the economy is and where it’s heading. Hard data has come in stronger than expected, almost at every turn. We note that the Atlanta Fed just raised its 3Q GDP Now forecast to 5.8%! Even as soft data continues to suggest economic weakness that seems to never come. However, since everyone who owns and/or runs a business must make decisions today based upon what they anticipate the environment to be in the future, i.e. current inventories, must be appropriate to future demand–this disconnect suggests that cautious decision-making today will eventually impact economic activity tomorrow.

The efficacy of utilizing and acting upon the NFIB.

Some commentators argue, the NFIB skews conservative and therefore is always positive during Republican administrations and negative during Democratic administrations. Hogwash — we reject that idea that every aspect of life or piece of data needs to be cast in a binary political light.

Perhaps perceptions of the forward-looking business climate are also influenced by actual historical realities – would anyone argue that Democratic administrations tend to have greater regulatory activism as part of their agendas, ostensibly to protect the little guy? The insights and data are no more or less meaningful than any economic data, which is almost always different than anticipated and often only well-understood after the fact, if at all – like calling a recession, which does not happen until the National Bureau of Economic Research says it happened at some point in the past. Recall that CPI measures the cost of housing in part utilizing owners’ equivalent rent – essentially asking homeowners how much they would charge to rent their own homes. Fed policy is then partly shaped by these replies.

Data based on surveys is no better or worse than it has ever been. However, given how AI is increasingly being applied to gathering and interpreting data, its usefulness may increase in the future. This is good news for small businesses.

Whether you are an economist or a small business owner, things are more confusing than ever. More data is always better. But not all data has the same informational value. Discerning what to pay attention to is key. And how to weigh the inputs is a matter of quantitative and qualitative judgements, which at the end of the day matters more than what a survey says.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURE:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.