Mark’s Musings: 11.9.22

The Productivity Head-Fake

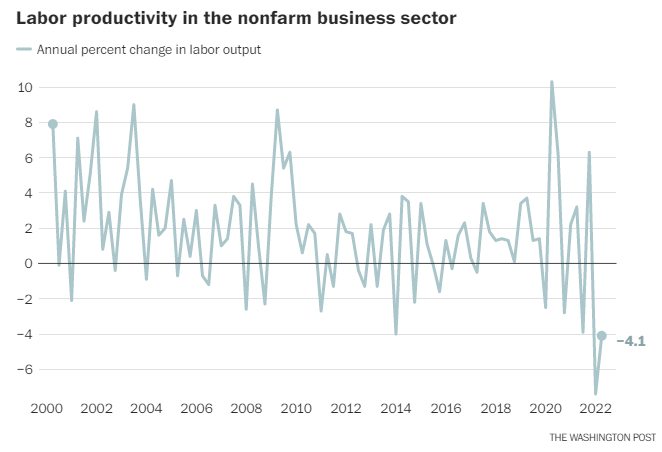

Like many things during the pandemic and the subsequent recovery, productivity was a headscratcher. You’ll remember from your college econ classes that productivity measures how much output (goods and services) an employee can produce in an hour. We were constantly told that employees were just as productive — if not more productive — working from home. Some even suggested that this new development could lead to higher long-term growth for the economy. Indeed, while there was some evidence for this thesis – in our opinion, much of it was anecdotal (and counterintuitive). It just didn’t seem right – workers got less accomplished when working in close quarters with colleagues? This, after years of touting corporate culture as a key determinant of success? Now, the Bureau of Labor Statistics tells us that in the first half of 2022, productivity fell the most since 1947. And CEOs are starting to get worried as well as the Fed – higher productivity combats inflation. We hope that there is still time to restore the link between hard work and the ultimate reward.

Skeptical of the Recent China Rally? We are too.

“Nobody is quite sure who wrote it, when it was written or if it’s even true.” The unverified post, a screenshot of four paragraphs, began circulating about a week ago and claimed that China’s information czar was developing a plan to re-open the economy by March of next year, presumably in a way that did not cause the communist Chinese government to lose “face.” It appears many investors were looking for any excuse to pick up heavily discounted shares of Chinese companies that have suffered under the shackles of a COVID-zero policy (among other self-induced issues). After all, it must end at some point – why not now? Since that time, the Hang Seng Index (Hong Kong) is up 13.1% (vs. S&P500 down -1.7%). Beware — even a short-term relief rally will not cure the many longer-term challenges that remain.

Are We Really Going to Run Out of Diesel Fuel?

“Inventories of ultra-low-sulfur diesel, heating oil and other distillates are at their lowest levels for this time of year since before the EIA started tracking them 40 years ago and diesel prices are in the stratosphere, all despite diesel crack spreads being in the record-high territory — a strong incentive for refineries to churn out more distillate.” The article singles out an appalling lack of refining capacity, specifically on the East Coast as only one-sixth of distillates are produced in the region, while the rest must be brought in from elsewhere. And much of that additional production from other areas have been redirected to Europe and European power producers have been stockpiling diesel to utilize if natural gas supplies are inadequate during the winter. The article suggests that higher prices and slower economic activity brought on by the impending recession will likely mitigate supply tightness in the medium term.

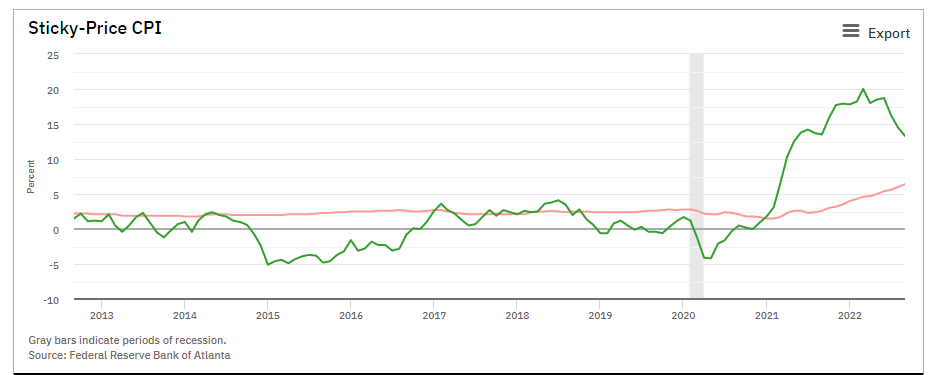

Sticky CPI? Yes, We Measure That.

Turns out the Atlanta Fed’s measure CPI based on component “stickiness – the sticky price index sorts the components of the consumer price index (CPI) into either flexible or sticky (slow to change) categories based on the frequency of their price adjustment.” The sticky-price consumer price index (CPI) increased by 8.5% (annualized) in September, while the flexible cut of the CPI decreased by 5.1% (annualized) in September. Perhaps offering some explanation for why the massive rollover and decline in certain input and material costs have had little impact on overall CPI.

An Answer to Climate Change – Build Fake Islands Filled with Luxury Bungalows

The Maldives, made up of 1,200 “specks of land sprinkled over hundreds of miles of Indian Ocean”, are dying. Island countries like this are on the “front lines of a losing battle with global warming.” According to NASA and the US Geological Survey, by 2050 roughly 80% of the country could be uninhabitable as most of the islands are just a meter above sea level. The solution – dredge the surrounding ocean to build man-made islands to preserve the country’s status as a tourist haven for the wealthy thereby rescuing the economy. The article demonstrates that these issues are complicated and solutions, while solving local problems, are often self-defeating on a global basis. Welcome to the real world.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.