Housing Markets and Liquidity

Remember in 2006/2007 when the market consensus was that anyone could refinance because housing always went up?

Similar situation now, except instead of relying on financing to drive prices, people are relying on the price appreciation since March 2020 to plan their ‘savings’ in real estate.

Long story short, prices are inflecting downward. Financial conditions are tightening and will take a while to reflect the structural change, which spells out ‘pain’ for housing.

Once people start taking losses and not seeing the same price appreciation, many landlords (big and small) may not value the cash flows from renting the same way, since they can get equivalent yields in US treasuries (or even high-yield for the more speculative sort).

Did we just see the inflection point this month (down) in home prices?

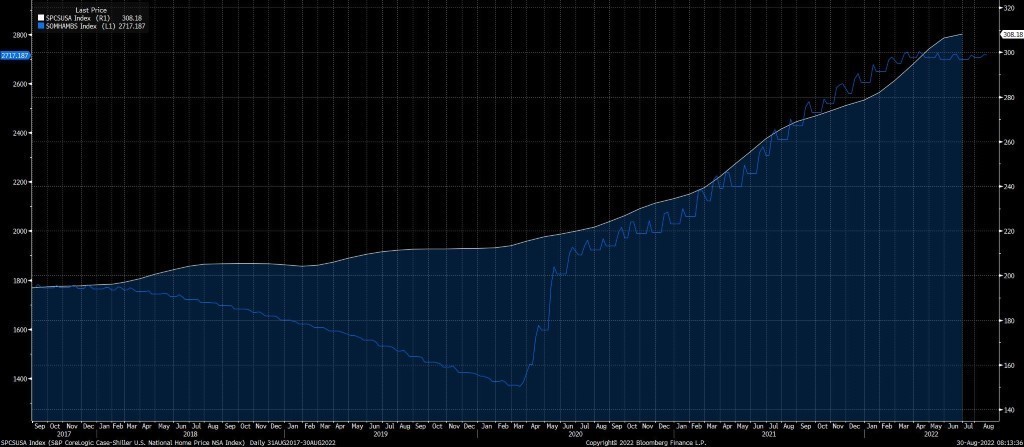

Here are two things to consider: 1) an article showing the first month-over-month decrease (MoM) in housing prices per the Case-Shiller Index SPCSUSA; and 2) this 5 Yr. graph below showing the Case-Shiller Index versus the US Federal Reserve’s holdings of [Agency] mortgage-backed securities (MBS). As of 8/30/22—Bloomberg.

Taken together, it tells an interesting story…

The Fed aggressively ramped up its buying of MBS in 2020 while there was the shift from multi-family to single-family holdings due to Covid. We saw the massive appreciation in housing prices since then. However, the Fed only recently started SLOWING its purchases and has yet to start SELLING its MBS supply. For example, in September the Fed will go from reinvesting proceeds of MBS in excess of a $17.5 billion cap and start only reinvesting proceeds in excess of a $35 billion cap. So, they are doubling the amount of MBS they are allowing to roll off their balance sheet in September.

Given the correlation between the two, and thinking about the funding mechanics behind mortgages, the shoe has yet to drop. Currently, the Fed has to buy so many MBS that it displaces private investors and pays a higher price, thus making the cost of funding mortgages artificially cheaper. Remember, this all occurs on a lag.

As the Fed buys less and transitions to selling MBS, private capital markets will have to absorb the supply, which has a lower limit than the Fed. This will: 1) drive up mortgage costs as investors demand more return for their money; and 2) limit the total available to borrowers since we’re now using private market balance sheets instead of the Feds.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.