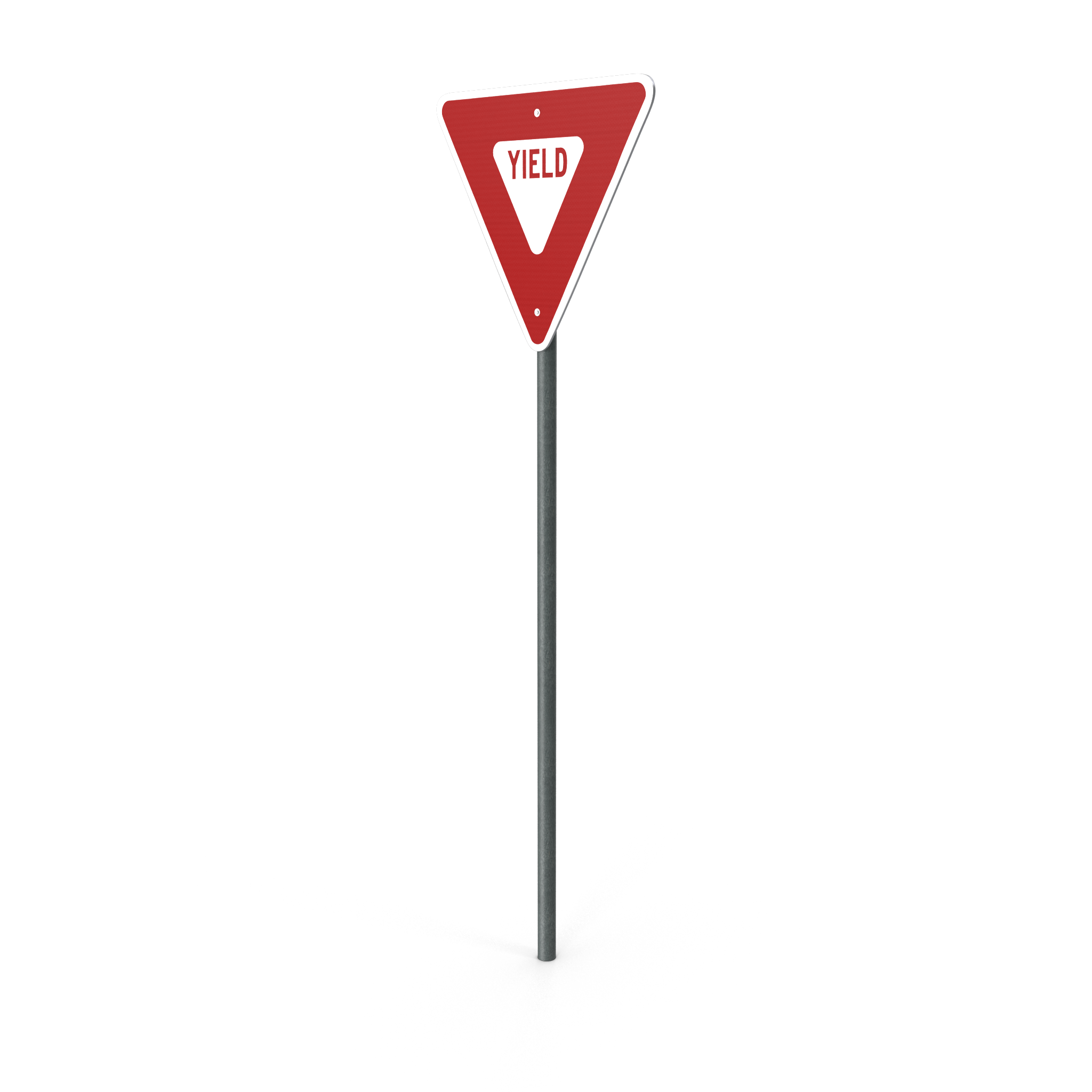

High Yield Can Mean Caution… or High Opportunity

“Boy, that double-digit yield looks pretty juicy…”

Slow down, big fella.

Often, double-digit yields indicate that the market doesn’t believe the current distribution is sustainable.

Usually, yields move higher as investors perceive more risk. In this way, a higher current return is delivered as a way of responding to those concerns and encouraging ultimate investment. A higher current return, at least in part, protects the investor from a total return perspective, if the price of the stock should decline.

Double-digit yields can certainly mean opportunity, given the right circumstances.

For instance, if a security has just come public, early investors may seek liquidity for reasons specific to their own needs/situation. On the other side, buyers may not be familiar enough with the security to be willing to step up and buy in a significant way. This can create a short-term disconnect between the market price and underlying fundamental value that can be exploited by investors who are willing to be patient for an efficient liquid market to develop.

How can an investor tell the difference? Details matter – details such as:

We believe there are multiple potential resolutions to atypical yields:

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.

VGI220324a