Expanding Cracks in the Ice

As we were releasing our blog on Friday, we received new consumer sentiment information from the latest University of Michigan survey that we referenced in our discussion.

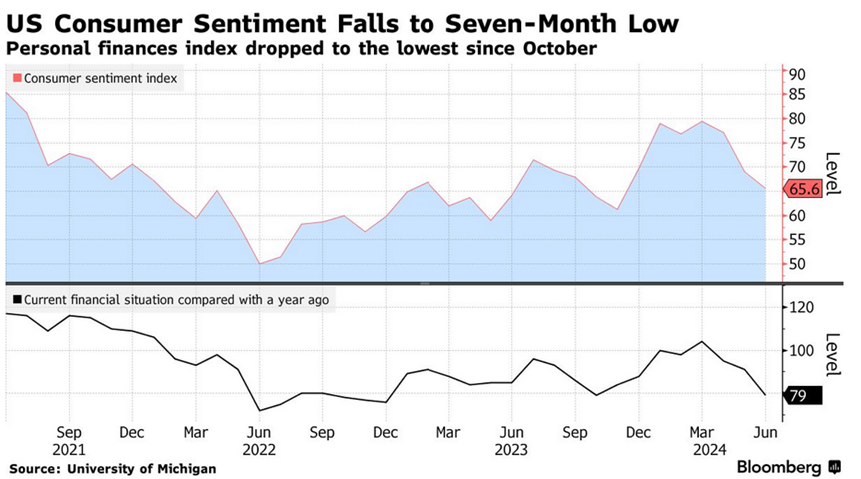

It was more bad news – like the sounds coming off the Khumbu Icefall as the sun rises over Everest. The Consumer Sentiment Index fell to 65.6 in June from 69.1 in May, while economists were expecting a rise to 72.

Seemingly perplexed, economists turned pundits are increasingly calling out “political polarization” as reasoning for why an economy doing so well could be so underappreciated by the masses. A Bloomberg newsletter post from Friday laments that “[t]he gloom that has held back President Joe Biden’s approval rating, despite a long and consistent list of positive indicators, just refuses to lift.” The implication – the average American cannot trust his/her own senses and needs more competent economic experts to interpret the information. The solution – completely submit to the reality distortion field of the elite in their ivory towers and all will be well. What nonsense.

Some other weaknesses surfaced as well, including higher expected prices over the next year (3.1% vs. 3.0% from prior month), less enthusiasm about personal finances (dropping 12 points to 79 from the prior month), and souring views about economic conditions (weakest level since end of 2022).

In our estimation, the black cloud hanging over the consumer has a straightforward explanation:

- Heated competition for workers post-COVID led to a (temporary) power shift in favor of the employee, resulting in a cycle of job hunting and rapidly rising wages.

- While wages increased meaningfully, on average they did not keep up with overall inflation — consumers were worse off but had plenty of excess cash to fill the gap.

- Even though disinflation has taken hold, overall prices remain much higher than 5 years ago.

- The Fed’s “higher for longer” policy (and accompanying higher cost of capital) is finally exacting an economic toll even as corporations run out of pricing power.

- Employers have embarked on “year(s) of efficiency”, reducing costs including finally rationalizing work forces bloated by the post-pandemic competition.

- The rise in artificial intelligence is calling into question previous assumptions about the timing, magnitude, and character of human resource needs, today and in the future.

Not surprisingly, all of this has the average consumer confused and concerned. It’s not that they are actually suffering today – in fact, the economy and most consumers are in pretty good shape. It’s that consumers are coming off such an artificial post-COVID “high” fueled by artificial stimulus and unrealistic employment demand that a more realistic, and in some ways threatening- environment seems much worse as a result. Our fearless leaders created an unsustainable reality and now they are paying the price – seems about right to us.

Sources:

Bloomberg, June 15, 2024: “US Consumer Sentiment Unexpectedly Falls to 7 Month Low”, Jarrell Dillard & “Why a Soft Landing May be Harder to Pull Off”, Ian Fisher and John J Edwards III

Validus Growth Research

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURES:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.

See social media content disclosure HERE