Are Small Caps an Attractive Hunting Ground?

There is a relative valuation discount in small caps that may create a target rich environment for investors searching for opportunities in individual companies.

Earnings season is getting into full swing this week. Let’s take a brief look at how small cap equities have performed fundamentally and how the group’s valuation currently stands.

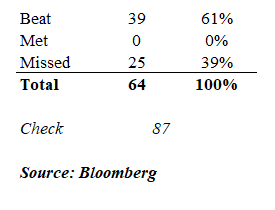

Per Bloomberg, of the 64 small cap companies that have reported earnings through 4/24/23, 39, or 61% have beat earnings estimates. As earnings season goes on, we will be watching to see how small caps fare against the lowered earnings estimates.

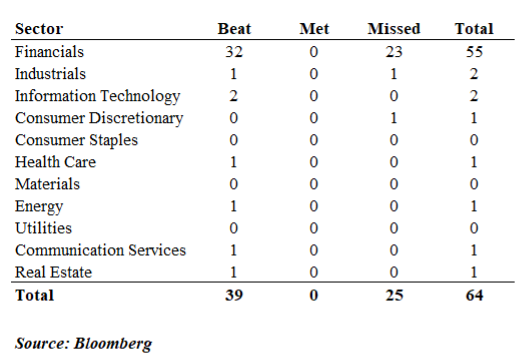

The Financials sector has seen the largest amount of small cap companies report earnings, representing 55 of the 64 earnings reported. Of those companies, 58% beat earnings estimates, while 42% missed them. This” beats to misses” ratio isn’t as clear cut an indicator as we’d like to see. However, given the banking crisis that we saw unfold with regional banks in Q1, we think it is a promising indication of things to come.

Digging deeper, the Tech sector was a distant second for most reporting companies, with only 2 companies reporting. Both of those companies beat earnings estimates for Q1 2023.

The overall outperformance of small cap companies is promising, since small cap equities are considered to be cyclical in nature and indicative of broader market performance.

Relative Valuation may provide attractive entry points for investors

On a relative valuation basis, small cap equities (defined as the Russell 2000 Total Return) trade at 20x forward earnings, which is below the 5-year average of 22.7x forward earnings. The graph below illustrates the discount by using the forward price-to-earnings [P/E] multiple for the Russell 2000 Index (monthly, over the last 5 years).

Small cap’s discount to its own historical average creates a potentially attractive entry point for investors looking to initiate exposure to small cap. We believe this indicates that if the index level is trading at a discount, there are certainly opportunities to find even greater relative value discounts when looking at individual companies within the small cap space.

As active managers, we believe understanding the specific companies an investor has exposure to is important and think that the market cap’s attractive valuation, overall, creates a richer hunting ground for the investor willing to do the work.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.