Investing in a Secular Bull and Bear Market

1999 definitely felt like the end of a secular bull market as the world feverishly prepared for impending doom of Y2K. The secular bear market that followed would see the tech bubble and a housing crisis wreak havoc on investment accounts everywhere and take nearly a decade for many portfolios to fully recover.

These were all cyclical market events playing out within a secular bear market.

According to Investopedia, “A secular market is driven by forces that cause the price of investments or an asset class to rise or fall over a long period. A cyclical market is shorter in duration than a secular market and often occurs during seasonal or cyclical business trends.”

Many experts agree, the last secular bear market started in 2000 and ended in 2013 (wthers say it ended in 2009) –which brought in the current secular bull market we are in. Here’s how the team at CFI defines a secular bull market:

“In secular bull markets, the prices of equities are likely to increase more than decline, and commonly, any short-term decreases in the prices are compensated for by the general growth in the prices over time.”

Although, if you agree with this article Lance Robert wrote for Seeking Alpha, we could be entering our fourth secular bear market. Here’s his take on a secular bear and bull market:

“In a “secular bear,” the market tends to trend sideways with severe drawdowns and sharp rallies. Three items drive secular bull markets: 1) valuation expansion, 2) earnings growth, and 3) falling interest rates.”

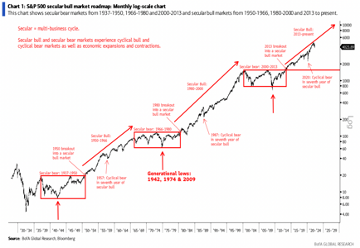

An article that Berry Ritholtz wrote has this chart he got from Stephen Suttmeier of Bank America Merrill that breaks down the length and returns of the S&P during different secular bull and bear markets, going all the way back to the 1930s.

Giri Devulapally at J.P. Morgan and team believes “a new secular bull market for equities began in February 2016. Their analysis finds that annualized total returns should average in the double digits until 2033–2035.

As for Validus, we tend to agree with those who say we’re experiencing a combination of cyclical events within a secular bull market. But it’s all good. Because true active investing can thrive in any market type–secular, cyclical, bull, bear, up, down, choppy or flat.

So, the question is, where are we now and what’s the best way to invest? This is exactly what we’ll be discussing in our next, advisor only, Strategy Session. Don’t miss it and make sure to get your spot today!

In the meantime, below is some more reading on the subject. And, as always, if you would like to discuss this one-on-one, give us a call or schedule an appointment.

Here’s some more reading on the subject:

https://www.thebalancemoney.com/secular-bull-bear-markets-357914

https://www.isabelnet.com/secular-bull-and-bear-markets/

https://corporatefinanceinstitute.com/resources/wealth-management/secular-market/

https://www.crestmontresearch.com/docs/Stock-Secular-Chart.pdf

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.