Contrarian Comfort at the Milken Institute

Last week, at the Milken Institute, we had lunch with one of the most prominent hedge fund managers of our time. It was a wide-ranging discussion that covered a host of topics including upcoming new product introductions.

Mostly though, we were taken by the similarities in our philosophy and approach. Here’s our takeaway…

- Diversification is not a silver bullet. Obviously, this is very counter to what we all have been encouraged to believe – after all, diversification is the only free lunch in investing, right? Not so much over the last 5-10 years (and especially not in 2023) when “spreading your bets” actually hurt performance as the MAG7 delivered an inordinate percentage of index returns (a well-documented phenomenon). To paraphrase the late Charlie Munger: “diversification makes very little sense for anyone who knows what they are doing….”

- Think asymmetry. What does that mean? Focus on potential investments / trades with multiples of upside while specifically defining risk to principal. Both Andy Grove and Rita McGrath refer to strategic inflections as 10x opportunities for companies. Validus has been applying similar logic to investments for over 10 years, seeking market and company-specific inflections through a proprietary research process that shifts the risk/reward equation in our favor.

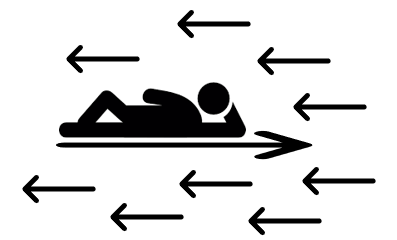

- Illiquidity is mispriced. Liquidity is undervalued. In our view, investors are not being sufficiently rewarded for locking up their capital for long periods. We have been conditioned to believe that beating public markets is futile – so, just index your liquid exposure. Then, for real returns, search far afield in the land of opacity for strategies to which only the “privileged” have access. Active managers like Validus have demonstrated that being research-based, stock-specific and liquid can be very rewarding.

- Capital calls can be challenging. Our hedge fund compatriot pointed out the current challenges of many endowments that were relying on “exits” and periodic redemptions from private investments to fund future capital commitments. As the exits have dried up and redemption have been curtailed (specifically, real estate), many now have cash flow issues, forcing them to sell other illiquid investments (having already dramatically reduced their liquid exposure) with unattractive timing and pricing. As an investor in private securities, Validus has dramatically reduced capital call structures within our illiquid allocation.

- Simplicity over complexity. Warren Buffet famously said that “investing is simple, but not easy.” We are firm believers in using quantitative methods combined with qualitative judgment to build portfolios. But just because something is “sophisticated”, doesn’t mean it’s always worthwhile. For example, risk parity strategies – complex risk-based allocation methodologies utilizing a myriad of asset classes including alternatives and employing leverage and short-selling – have significantly underperformed even the traditional 60/40 portfolio over the last five years. In our experience, the direct path is often the better play.

It’s hard to think of a better way to spend an afternoon then sharing similar thoughts about investing with a top hedge fund manager. There’s a special kind of “contrarian comfort” in knowing some ideas are timeless and enduring–regardless of the latest consensus.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURES:

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.