Hey, that’s my job!

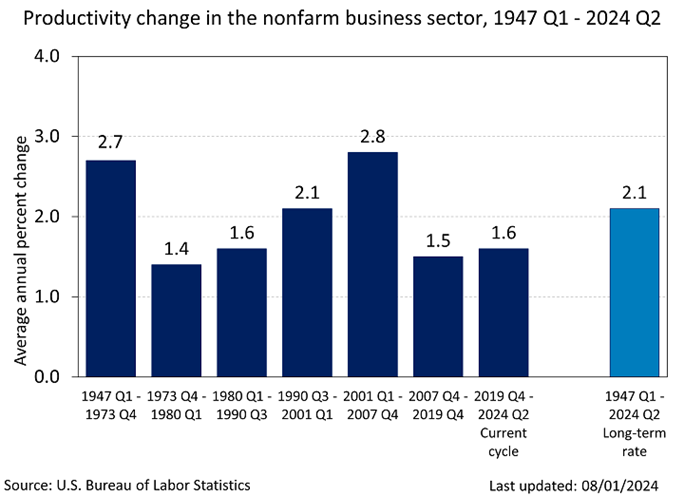

AI is in the in the early innings of being applied to mainstream businesses, creating operating efficiencies and transforming tech spend along the way. As a result, AI-fueled implementations will drive productivity levels back to long-term averages after the anemic pace of a post-GFC (Great Financial Crisis) world.

Despite most traditional thinking that productivity gains are good for employment, consider the other side and check out this blog we wrote in November 2023 entitled That old bugaboo… . The potential for higher levels of structural unemployment in the coming years, due to technological advancements, is now supercharged by the sudden accelerated adoption of AI throughout the enterprise. We never bought the logic that AI would create a utopia for workers with more rewarding, higher-purpose jobs for everyone. The idea that “You’ll never have to do a mundane task again” meets you won’t be doing any task at all.

But it’s much worse than that, because many companies – especially the larger ones – loaded up on employees at higher wages, post-COVID, in a frenzied attempt to address what everyone believed was the new normal. They over-hired and over-paid, temporarily shifting the balance of power to employees and causing many to herald a new era of workers’ rights. This “moment in the sun” has passed in our estimation. And these companies are now in the process of normalizing their workforces either through hiring freezes, where attrition leads to fewer employees more slowly over time (much as the Fed is doing with its balance sheet as bonds mature), or with outright layoffs / terminations. For example, Intel Corp., the struggling US chip maker that’s seemingly lost its way, was the latest to announce a 15% reduction of its workforce (15,000 employees) earlier this month.

And Sebastian Siemiatkowski, the CEO of Klarna seems to agree. It was reported in the Financial Times and in other business publications that Klarna, a private fintech “buy now, pay later” juggernaut, plans to eliminate roughly half (50%) of its workforce over the next few years, after already cutting staff by almost 25% over the last year, because “[n]ot only can we do more with less, but we can do much more with less….” Apparently, Klarna’s CEO has become one of the most vocal advocates among European corporate leaders of the beneficial impacts of AI, even if it should result in lower employment levels. According to the article, he argues that employment is an issue for governments to worry about. Turns out, something else we agree on.

The job of corporations is to maximize profits for its shareholders while being generally good public citizens – obeying the laws, treating workers fairly, etc. The ESG “hooey” (yes, that’s a technical term) that suggests equal stakeholder-ship for environmental, social and governance causes is also fading as those that have embraced this logic, some under threat, have failed to keep pace both in terms of fundamental and stock price performance. And yes, we are capitalists. In the end, it’s not a company’s responsibility to ensure full employment for workers. Rather, this responsibility falls to governments in the form of things like monetary policy, lawmaking and regulation.

As all this unfolds, expect to hear more and more calls for “universal income” from politicians and wealthy elites – essentially unearned, unworked income and something Pope John Paul II warned the world about when he discussed the “dignity of work” in Laborem Exercens, after living under the thumb of communist totalitarian regimes throughout most of his life.

Technology and progress are not bad things in and of themselves. However, with such a substantial societal inflection like AI, there will be significant ancillary impacts that may take more time to prepare for and adjust to when juxtaposed against the faster pace of technology adoption. For many, small businesses, including boutique RIAs like ours, where machining processes with AI allows for getting more done with less, it could be a big win.

Are you a Financial Professional? Then check out our new portal and get all kinds of tools and resources on multi-strategy investing, and growth.

IMPORTANT DISCLOSURES:

Securities highlighted or discussed in this blog have been selected to illustrate Validus’s investment approach and/or market outlook and are not intended to represent any strategy or portfolio performance or be an indicator for how strategy or portfolio have performed or may perform in the future. Each security discussed in this blog has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in aggregate, may only represent a small percentage of a strategy or portfolio holdings. The strategies and portfolios are actively managed, and securities discussed in this blog may or may not be held in such strategies or portfolios at any given time. These individual securities do not represent all the securities purchased, sold, or recommended and the reader should not assume that investments in the securities identified and discussed were or will be profitable. Nothing in this blog shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this letter.

Validus Growth Investors, LLC seeks to invest in companies at every stage of their growth. From startups to publicly traded companies, our research identifies inflection points that have the potential to produce meaningful growth and income for the clients we serve.

Investment Advisory Services are offered through Validus Growth Investors, LLC (“Validus”), an SEC Registered Investment Adviser. No offer is made to buy or sell any security or investment product. This is not a solicitation to invest in any security or any investment product of Validus. Validus does not provide tax or legal advice. Consult with your tax advisor or attorney regarding specific situations. Intended for educational purposes only and not intended as individualized advice or a guarantee that you will achieve a desired result. Opinions expressed are subject to change without notice. Investing involves risk, including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining value. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions and projections are as of the date of their first inclusion herein and are subject to change without notice to the reader. As with any analysis of economic and market data, it is important to remember that past performance is no guarantee of future results.

See social media content disclosure HERE